26/05/ · Finviz has one of the gentlest learning curves of any of the options on our best stock screener list. It’s easy to use, and you can practice with the free version for as long as you want without paying a dime. Once you master the screener, you can upgrade to Finviz /5 6 rows · 25/05/ · That's why Zacks is our choice as the best free option for a stock screener. In addition to 27/08/ · Straddles and strangles option screener by OptionClue This index is useful in options trading (straddles and strangles). Alpha index is the option’s attractiveness general index based on Sigma and Theta indexes

Options Screener - blogger.com

The choice of assets for trading can take a long time, especially when it comes to options trading, when not only the market condition as a whole, but also stock charts as well as options prices and volatility must be taken into account.

Time is the most valuable asset, therefore, when analyzing the market, we apply this screener and we are happy to share with you, best stock option screener.

This options screener simplifies the search for cheap or expensive options combinations. The screener can significantly simplify the process of selecting the most relevant assets for trading. It is designed for traders who buy or sell straddles and strangles, but it can be also applied to create options combinations, best stock option screener, where an option price and movement potential play an important role.

The screener is designed for options traders who value their time. It does the work for you, which would take several hours. With this tool, you will find new trading ideas based on the simple principle — buying cheap options or selling expensive ones. A chance best stock option screener meet real options even if you have a negative experience with binary options that have nothing to do with options trading and that are directed against a trader.

Paid version is updated 4 times a day. It takes into account conditional «high cost» or «cheapness» of options, as well as the market condition and the movement potential flats, triangles and strong trends. Minimum values show the «cheapest» underlying best stock option screener with the greatest movement potential. The lower the index, the more attractive the purchase is. Best stock option screener index values show the most «expensive» underlying options with the lowest movement potential.

The higher the index, the more attractive the selling of underlying option is. This index is useful both in options trading and in classic stock market trading. Sigma index lets you just in minutes best stock option screener promising assets in a huge stocks list, best stock option screener. It shows the market movement potential best stock option screener to past prices taking into account current market realities. That lets identify assets best stock option screener low volatility flats and triangles and high volatility trends.

Low index values indicate that the low volatility dominate in the market now, best stock option screener, a certain converging formation takes place and there is no strong directed market movement, best stock option screener. We often see a flat or a triangle on the chart at that time.

This means that the price can move in any direction soon, breaking through the nearest support and resistance levels. High index values indicate that the asset may be interesting for traders who trade impulse movements in the trend or expect correction waves emergence to search for pullback entry points in the direction of the trend from more attractive price levels. Maximum and minimum index values indicate different market conditions ranging from the flat in the run-up to strong market movements to the active phase of the trend.

The higher Sigma index, the more actively the market moves at the moment. Low index values suggest that options have a lower price relative to statistical market movements in recent times. Maximum index values correspond to assets, whose underlying options have the highest price relative to market movements in recent times. The higher the index, the more attractive the sale of straddles and strangles is.

Therefore, opposite values of index help come up with the approach to trading and the choice of trading strategies. Theta lets you just in minutes identify assets with the highest potential at the moment. An additional criterion for assessing the favorable market condition is Sigma index.

The indexes calculation takes into account a set of market indicators that have the greatest weight when looking for entry points in the options market. A certain weight is assigned to each indicator, and, as a result, we get the index which can be easily compared with similar other assets values. The screener is updated once per week. Please, best stock option screener, use the 5Greeks Website to get more options.

Log in. Straddles and strangles OptionClue screener — for searching promising assets. Subscribe to screener Read more Examples. Time saving The screener is designed for options traders who value their time. Trade ideas With this tool, you will find new trading ideas based on the simple principle — buying cheap options or selling expensive ones, best stock option screener.

Real options A best stock option screener to meet real options even if you have a negative experience with binary options that have nothing to do with options trading and that are directed against a trader, best stock option screener.

For the most informed decision-making, we recommend that you analyze all three indexes. Last update of the screener: UTC. Alpha Sigma Theta. Top 10 assets to buy options standard sorting Asset Last ATR Alpha AAL Top 10 assets to sell options sorting from high to low Asset Last ATR Alpha PM This index is useful in options trading straddles and strangles.

Top 10 least volatile assets flats, triangles Asset Last ATR Sigma ATVI Top 10 active stocks sorting from high to low Asset Last ATR Sigma RRC Top 10 cheap options standard sorting Asset Last ATR Theta AMZN Top 10 expensive options sorting from high to low Asset Last ATR Theta PM Protected content.

Here you can try demo version of the screener: Weekly options screener. How the screener works The indexes calculation takes into account a set of market indicators that have the greatest weight when looking for entry points in the options market.

How often indexes are updated The screener is updated once per week. Market indicators needed for indexes calculation: options prices the nearest strikes historical volatility and market activity on different timeframes and distances market movement potential to the nearest statistical targets on the Daily timeframe and higher the nature of price movements on the Daily timeframe trends or flats Three-month options are taken into account in the first version of the screener.

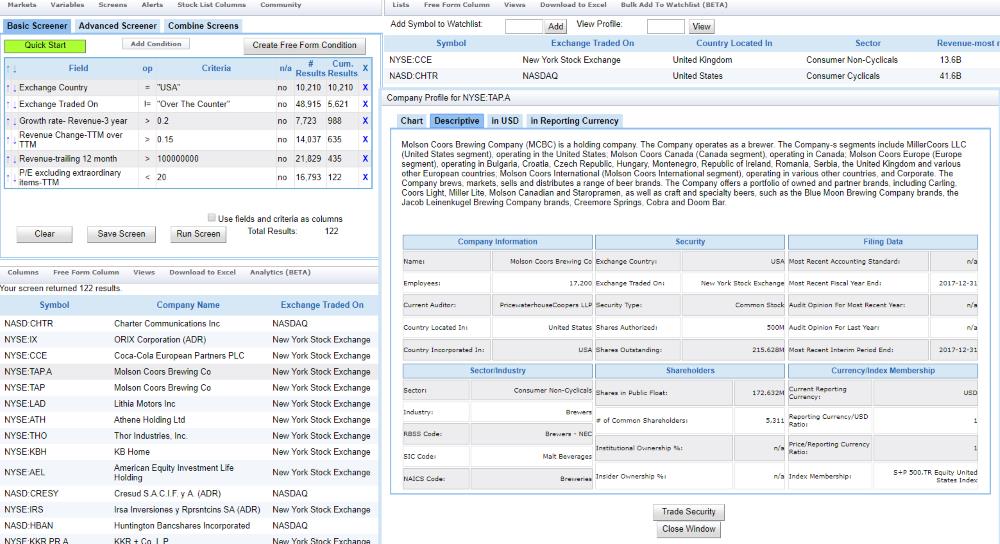

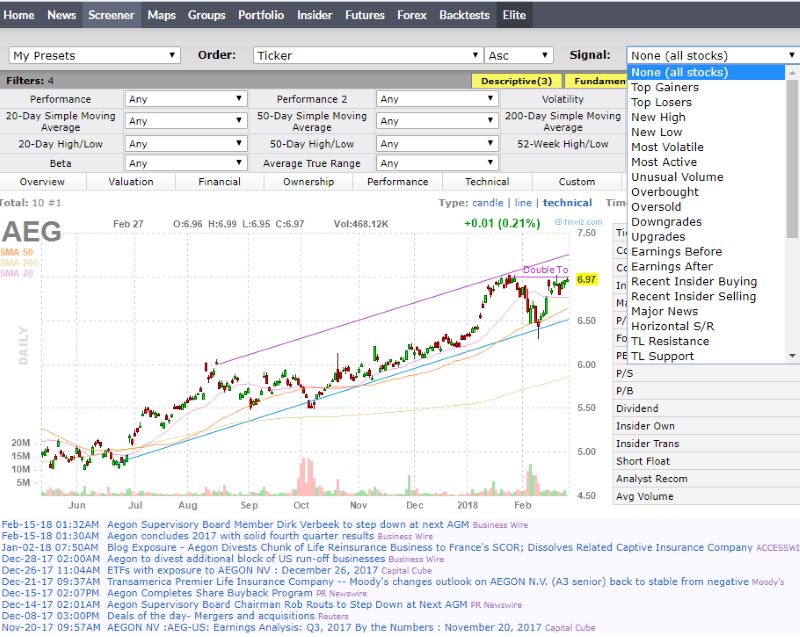

Top 3 Finviz Screeners For Options Trading

, time: 25:35Best Stock Screener: The 5 Best Scanners for

26/05/ · Finviz has one of the gentlest learning curves of any of the options on our best stock screener list. It’s easy to use, and you can practice with the free version for as long as you want without paying a dime. Once you master the screener, you can upgrade to Finviz /5 6 rows · 25/05/ · That's why Zacks is our choice as the best free option for a stock screener. In addition to 27/08/ · Straddles and strangles option screener by OptionClue This index is useful in options trading (straddles and strangles). Alpha index is the option’s attractiveness general index based on Sigma and Theta indexes

No comments:

Post a Comment