Bollinger Bands can be used on most financial time series, including equities, indices, foreign exchange, commodities, futures, options and bonds. Bollinger Bands can be used on bars of any length, 5 minutes, one hour, daily, weekly, etc. The key is that the bars must contain enough activity to give a robust picture of the price Chart 1: On 20 July prices tagged the upper Bollinger Band while day Intraday Intensity was deep in negative territory setting up a sell alert. The first down day was the sell signal and entry. The red triangle is a negative PowerShift 16/07/ · Bollinger Bands are a powerful technical indicator created by John Bollinger. The bands encapsulate the price movement of a stock, providing relative boundaries of highs and lows. The crux of the Bollinger Band indicator is based on a moving average that defines the intermediate-term "trend" based on the time frame you are blogger.comted Reading Time: 9 mins

Bollinger Bands Indicator: Breakout Forex Trading Strategy + More - Admirals

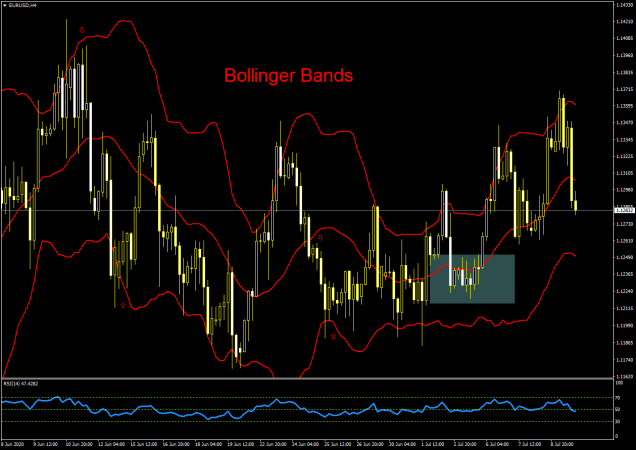

This bollinger band strategy is a continuation trading strategy that also uses the 20 period moving average of the bands for trend direction, bollinger bands 20 1. Bollinger bands are a good measure of volatility of the instrument you are trading and we can use this to form the basis of a swing trading system for Forex or any other market.

The theory is that the settings of the top and lower bands the standard deviation from the moving average contain price action. Any price movement that touches or exceeds the upper or lower band show a market that has increased volatility. This often can set up some great trading opportunities. The bollinger bands are a technical indicator similar to the keltner channel as they are both bands and a measure of volatility.

One main difference is the keltner channel uses average true range for the calculation. You can use the bollinger band strategy on any time frame but like most trading signalsbollinger bands 20 1, a higher time frame trade setup is often more reliable.

We bollinger bands 20 1 to see price moving above the middle line of the bollinger bollinger bands 20 1. You want to see price pullback into the area of the middle line to initiate a buy bollinger bands 20 1. You will then look for a price action setup that shows price has a probability of travelling back to the upside, bollinger bands 20 1.

You can also use an opposing trend line break for entry. For selling, we want to see price visit the lower part of the band and either touch or pierce the bands. From there, price pulls back into the area around the 20 period moving average middle line. The bollinger bands actually have a built in indicator for profit taking : the outer bands.

One price has touched the middle line for a buy or sell signal, look for price to travel to bollinger bands 20 1 upper or lower band to take your trading profits. You can also use a Fibonacci measurement for profit taking and trade management. This is a more advanced bollinger band strategy as I am using a combination of technical analysis to trade this chart. This highlights that while technical indicators such as the bollinger band can aid you in trading, price action will always rule.

Bollinger bands can frame price and show you when there is an extreme move worth noting. Your trading system may require price movement touching or exceeding the upper or lower bands before taking a trade.

You can use these as a mean reversion system bollinger bands 20 1 a continuation swing trading strategy. The mean reversion aspect is a more advanced bollinger strategy and is shown in the second trade example in the last chart.

Bollinger bands can keep you objective in your trading by offering you not only a place to consider a trade, but areas to consider taking profits as described above. Whatever way you choose to use the bollinger bands as part of a swing trading strategy, ensure you test it and log a trade plan so you can stay on track, bollinger bands 20 1. Another use of the bollinger bands is to measure price compression and a break from the consolidation, bollinger bands 20 1.

This is used in conjunction with the keltner channel and is called the squeeze. The Bollinger Band Squeeze can also be a trading system but like every trading method, test your idea before putting money on the line.

Name required. Mail will not be published required. Forex Swing Trading Strategy 6: Bollinger Bands Strategy This bollinger band strategy is a continuation trading strategy that also uses the 20 period moving average of the bands for trend direction. Bollinger Bands Indicator The bollinger bands is made up of three lines: Top band, middle band, and lower band. Using the standard bollinger band setting for this strategy, the lines are: Top line is 2 standard deviations from the middle line to the upside The middle line is a 20 period moving average Lower line is 2 standard deviations to the downside from the moving average Bollinger Bands Standard Settings.

Bollinger Bands Strategy For Swing Trading. Bollinger Band Strategy With Fibs and Price Action. Posted in Simple Swing Strategies. Forex Swing Trading Strategy 6: Inside Bar Trading Strategy ».

Leave a Reply Click here to cancel reply. Copyright © - About Us Contact Advertise Sitemap Privacy Policy Disclaimer. Powered by WordPress Designed by: Free WordPress Themes Thanks to Bollinger bands 20 1 WordPress ThemesBest Wordpress Hosting and Promo Codes.

Bollinger Bands and RSI Trading Strategy (Simple and Effective)

, time: 9:52Bollinger Bands Trading Strategy Explained-5 Best Examples - blogger.com

27/07/ · Best Bollinger Bands Settings: Bollinger bands setting for intraday traders, specially for a beginner it is advisable to use the default 20 day SMA and 2 SD setting, With time you can do various experiments and can try different other BB blogger.comted Reading Time: 9 mins Bollinger Band®: A Bollinger Band®, developed by famous technical trader John Bollinger, is plotted two standard deviations away from a simple moving average 31/05/ · Bollinger Bands (20,2); and; RSI (14). Depicted: Admiral Markets MetaTrader 5 - GBPUSD H1 Chart Date Range: May 28, , to June 1, Captured: June 1, Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial Estimated Reading Time: 8 mins

No comments:

Post a Comment