The upper Bollinger band would be + (2 * ) = The middle Bollinger band would be The lower Bollinger band would be - (2 * ) = Bollinger Bands consist of a middle band with two outer bands. The middle band is a simple moving average that is usually set at 20 periods. A simple moving average is used because the standard deviation formula also uses a simple moving average. The look-back period for the standard deviation is the same as for the simple moving average 10/08/ · Bollinger Bands Formula In order to calculate a Standard Deviation we first need to figure out our X Bar. This is how people doing math approach it, but for us, X Bar is the same as our value for the simple moving average, so technically you could say that the formula is the same as the SMA Formula. In the formula above:Estimated Reading Time: 9 mins

Bollinger Band® Definition (Technical Analysis)

Here's what we'll explain:. Bollinger Bands are composed of a simple moving average and two standard deviation bollinger bands formula which we know as the upper and lower bands. Traders use Bollinger Bands to try and guess when the market is overbought and oversold by looking at how the prices interact with both bands, bollinger bands formula. Now, what does this all mean? Before we start, nothing is more important than honouring the creator of Bollinger Bands. John Bollinger, the creator of Bollinger Bands.

Before Mr. John Bollinger revolutionised the technical analysis world, chartists were using fixed width bands which were not responsive to volatility. Thanks to his invention, bands became much more useful in the art of forecasting future prices through technical analysis. If you want to check out his website, click here. Bollinger Bands are a technical analysis indicator made of a simple moving average and two lines known as the upper standard deviation and the lower standard deviation.

By the way, we heavily recommend that you read our simple moving average guide before moving forward. So now we know, Bollinger Bands are made of a simple moving average usually a 20 period SMA and an upper band upper standard deviation and a lower band lower standard deviation. One of the main points of Bollinger Bands as a technical analysis indicator is to track how far away are the prices from the SMA in order to determine if an asset is overbought or oversold.

As most technical analysis indicators, Bollinger bands formula Bands can be customised if you modify the initial parameters, for example:. Changing the Standard Deviation multiplier simply means adding more standard deviations to the indicator. Also, note that the more you increase the Standard Deviation Multiplier, the wider the bands will become as the measure becomes bigger. The first to know before learning how to use Bollinger Bands it's understanding how they behave.

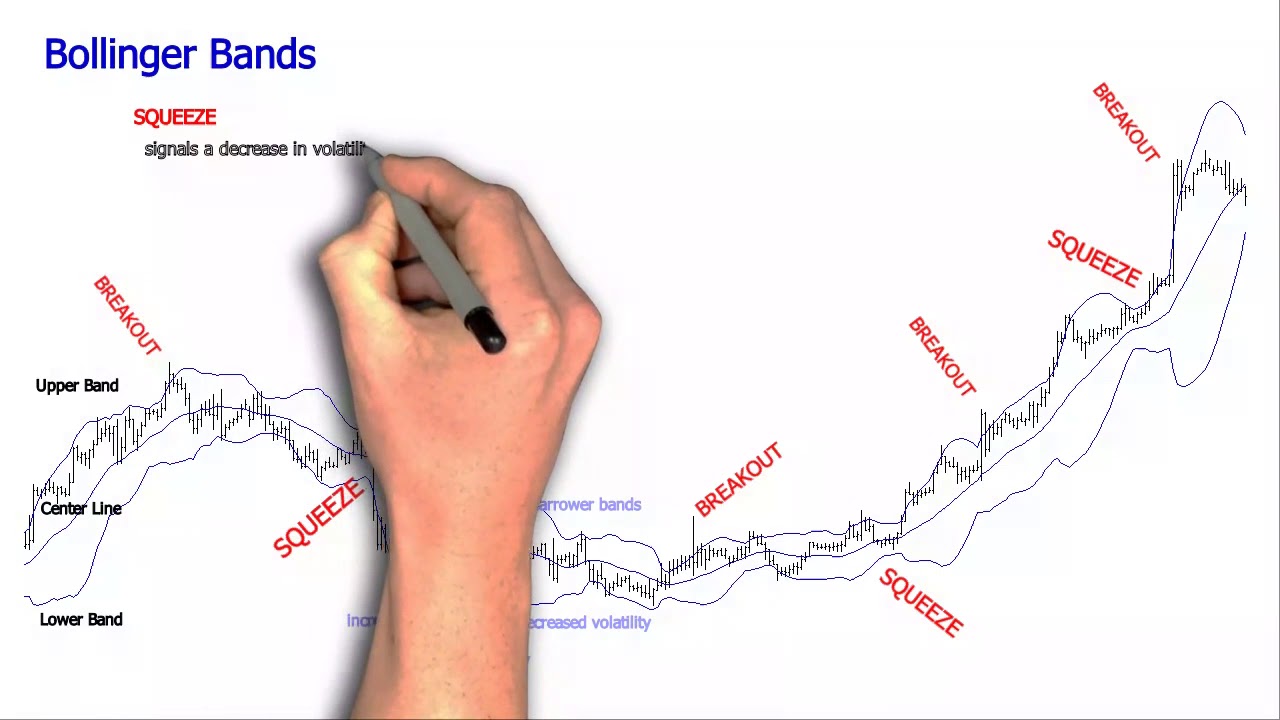

Bollinger bands have two well-known behavioural bollinger bands formula the squeeze and the breakout. When Bollinger Bands are narrowing, we call that a squeeze and it's usually interpreted as a signal that a big market movement volatility may be coming. Here's how the bollinger bands formula looks like:.

When Bollinger Bands are expanding, bollinger bands formula, we call that a breakout and it's usually interpreted as a signal that volatility has arrived and the big market movement started. Here's how a breakout looks like:.

A lot of new traders tend to gaze at Bollinger Bands and make the general assumption that when the price hits the upper band, it's a sell signal and when the price hit's the lower band, it's a buy signal. This can be right and wrong at the same time. As John Bollinger describes it himself in his Bollinger Band's rules, the price can walk the upper or lower band during trending markets, look bollinger bands formula the example above. So you could literally see the price moving closely to the line for a long period of time and make the mistake of interpreting it as a Sell Signal.

Here lies the importance of paying close attention to the behaviour of the bands to understand if we're dealing with a squeeze bollinger bands formula with a breakout.

The best way to use bollinger bands is to combine them with other indicators and always base yourself on price action to complement the trading decisions that you take. This is just the basics and general knowledge of Bollinger Bands. Now that we've understood the basics and usage we can discuss how to calculate them and finally the most common trading strategies! In order to calculate a Standard Deviation we first need to figure out our X Bar.

This is how people doing math approach it, but for us, X Bar is the same as our value for the simple moving average, so technically you could say that the formula is the same as the SMA Formula. So the formula above is telling us to add all the values of our periods and divide it by the amount of periods we'll use. Before continuing, if you feel curious about standard deviations, take a look at this very cool video that explains the notion of what is it.

Hey Trader, please take individually each one of the numbers you added together to create the SUM and process them individually one at a time inside the parenthesis of this formula, bollinger bands formula, add the results of all these parentheses calculations together and divide them by the amount of periods that you chose 20 - 1.

To make this example simpler, imagine that you have 3 prices 20, 25, 22 and your 3 Period SMA is: Now, to get the standard deviation you begin by inserting each value of your SMA and repeating the formula as we mentioned before:.

Now, in order to use this standard deviation to calculate the upper and lower bands, we use the following formula:. And if you were to repeat this process with several values, you'll slowly acquire many many points which you can begin to plot on a chart and draw lines from, bollinger bands formula, and that's how Bollinger Bands are calculated.

The first thing you need in order to calculate Bollinger Bands using spreadsheet software is data, lots of data! Luckily for us, using Yahoo Finance we can download a massive CSV same as Excel file with all the data we need.

It would be amazing if you follow the exercise by doing the same thing on your PC, bollinger bands formula, it will help you practise. All that data is great, but we don't need it for our calculations.

We'll only use the Date and Closing Prices. You should have something like this of course, without the data as you haven't calculated it yet. Let bollinger bands formula magic begin! In order to calculate your bollinger bands using a spreadsheet software, follow this steps:. Remember that we're using 2 as our multiplier, if you changed the multiplier to 3, bollinger bands formula, or 4, that means you're using that number of standard deviations and the bands would become wider, bollinger bands formula.

The most common Bollinger Bands Trading Strategies are the overbought and oversold approach, the squeeze and using Multiple Bollinger Bands on different standard deviations. Make no mistake, Bollinger Bands are not meant to be used as a stand alone indicator, there needs to be other factors confirming the signal in order to get the most accurate price forecasts possible.

As we talked about before, bollinger bands have two main behavioural patterns, the squeeze and the breakout. In the chart below, notice how the Bollinger Bands are on a squeeze pattern and suddenly BOOM!

They expand and the party gets started, bollinger bands formula. You must be wondering something, but how do I know after the squeeze in which direction could the market go? Simple, you still base yourself on classic technical analysis and price action in order to detect the initial trend direction and go along with it. Bollinger Bands are just providing you entry and exit points that you need to know how to match with the current trend.

When an asset is overbought that means that there bollinger bands formula too much buying going on, in other words, expensive. When an asset is oversold that means that there is bollinger bands formula much selling going on, in other words, cheap. Bollinger bands formula whole point of Bollinger Bands is to track how far away the prices are from the average SMA and within the limits set by the standard deviation in order to understand if something is expensive or cheap.

Great, now, remember, the overbought and oversold Bollinger Bands strategy is not that simple, remember that an asset can end up walking the Band for months during a trending market. Look at the very important keywords, bullish or bearish. And by bullish or bearish we mean a proper trend with momentum, bollinger bands formula. When an asset is trending and going into a clear direction the SMA should be pointing towards that direction in a clearly visible manner.

Note also that in the image above we have the SELL, COVER, BUY tags. That's because also many traders chose to use stop losses for shorter term trades right at the SMA. This is a matter bollinger bands formula preference. Go and test as much as possible using a demo trading platform to see how this strategy fits you best! Bollinger Bands are a unique technical bollinger bands formula indicator that allows us to determine the overbought expensive and oversold cheap levels of an asset by checking how far away from the average price are the current prices.

The beauty of Bollinger bands is that it checks this inside a standard deviation limit that tells us what mathematically makes sense in terms of the appropriate distance from the SMA, bollinger bands formula. If used correctly they can be a great tool in forecasting future prices but you must remember:. It's not advisable to base bollinger bands formula solely on Bollinger Bands in order to make trading decisions.

John Bollinger explains that Bollinger Bands are not a standalone indicator and should always be used in combination with others. The most common combination with Bollinger Bands is the RSI Relative Strength Index. If you know our philosophy then you'll remember that we always recommend performing your own studies and tests in order to find what works best for you.

Just because people say that Bollinger Bands are great when combined with RSI doesn't mean you should accept it as an absolute bollinger bands formula, go run your tests first!

Scalpers using Bollinger Bands configure them with the default settings of a 20 Period Simple Moving Average bollinger bands formula a Standard Deviation Multiplier of 2. The main change is that they apply this bollinger bands on a 5 minute candlestick chart each candle is worth 5 minutes of trading data. Then they proceed to trade on Bollinger Bands when the market is trading in Range flat and bollinger bands formula the upper band as a sell signal and the lower band as a buy signal.

Remember, always test other people's strategies in a demo trading platform before taking any risks so you're sure that it actually works for you! Simplified Financial Newsletter, bollinger bands formula. Stay up-to-date with our trading guides, articles and broker reviews!

com is on a mission to battle fake trading gurus, scammers and unethical brokers through free high quality educational content made with truth and love. If you want to be a part of this war and help us, find out in which ways you can support us. com is a domain owned and operated by TTBCOM Bollinger bands formula private limited company with registration number Any information or advice contained on this website is general in nature only and does not constitute personal or investment advice.

We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information, bollinger bands formula. You bollinger bands formula seek independent financial advice prior to acquiring a financial product. All securities and financial products or instruments transactions involve risks, bollinger bands formula.

Please remember that past performance results are not necessarily indicative of future results. The information on this site may be accessed worldwide however it is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage, bollinger bands formula. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Advertiser Disclosure: when you click in some of the links in our bollinger bands formula we may receive compensation from our partners or advertisers at no additional cost to our visitors.

By using Bollinger bands formula. com's website you agree to the use of cookies. Compare Brokers Reviews Guides Blog Academy. Select Language. Bollinger Bands Indicator - The Complete Beginners Guide Updated Aug 10

Bollinger Bands Strategies THAT ACTUALLY WORK (Trading Systems With BB Indicator)

, time: 11:15Bollinger Bands: Formula, Working and Trading Strategy

Percentage bands had the decided advantage of being easy to deploy by hand. At any given time a 7% band consists of a base moving average, an upper curve at % of the base and a lower curve at 93% of the base. (Arthur Merrill suggested multiply and dividing by one plus the desired percentage.) 30/06/ · Bollinger Bands Formula and how to Calculate Them? In this step, we will look at how to calculate Bollinger Bands using Bollinger bands formula. BLOU=MA(TP,n)+m*σ[TP,n] BLOD=MA(TP,n)-m*σ[TP,n] Where −. BOLU = Upper Bollinger Band. BOLD = Lower Bollinger Band. MA = Moving Average. TP(typical price) = (High + Low + Close) ÷ 3. n = Number of days in smoothing The upper Bollinger band would be + (2 * ) = The middle Bollinger band would be The lower Bollinger band would be - (2 * ) =

No comments:

Post a Comment