Highlights Workers are sometimes granted stock options as part of their annual pay. Employee stock ownership plans grow wealth on a tax-deferred basis. Company stock plans allow employees to invest without paying broker’s fees. Investing» The Pros And Cons Of Company Stock For many American workers, there are no words more magical than company [ ] maximization. These are not the only benefits of stock options, however. Other advantages can be summarized as follows: Alignment Of Interests One of the widely accepted advantages of using stock option compensation is that the agency conflict between managers and shareholders is reduced2 08/06/ · To help you decide whether or not stock options are a good idea for your employees, let’s take a look at some of the pros and cons. Pro: Employees Become a Bigger Part of the Company. Keeping employees motivated can be blogger.comted Reading Time: 3 mins

The pros and cons of offering employee stock options | HRD America

One industry educator offers her expert opinion on the popular alternative to cash-only compensation. You've reached your limit - Register for free now for unlimited access. To read the full story, just register for free company stock options pros and cons - GET STARTED HERE. Forgot password? CONTINUE TO SITE. During the dotcom boom of the late nineties, stock options were a major draw that brought top talent to emerging tech companies.

However, after the dotcom bust, many of these companies became insolvent, and executives were left holding worthless stock options. Today, stock options are still a part of the packages offered by many companies, company stock options pros and cons. However, they typically serve as an added perk and not as a replacement for a competitive salary.

In addition, employee stock options are no longer reserved for executives, and now exist for many other employee groups at businesses of varying sizes.

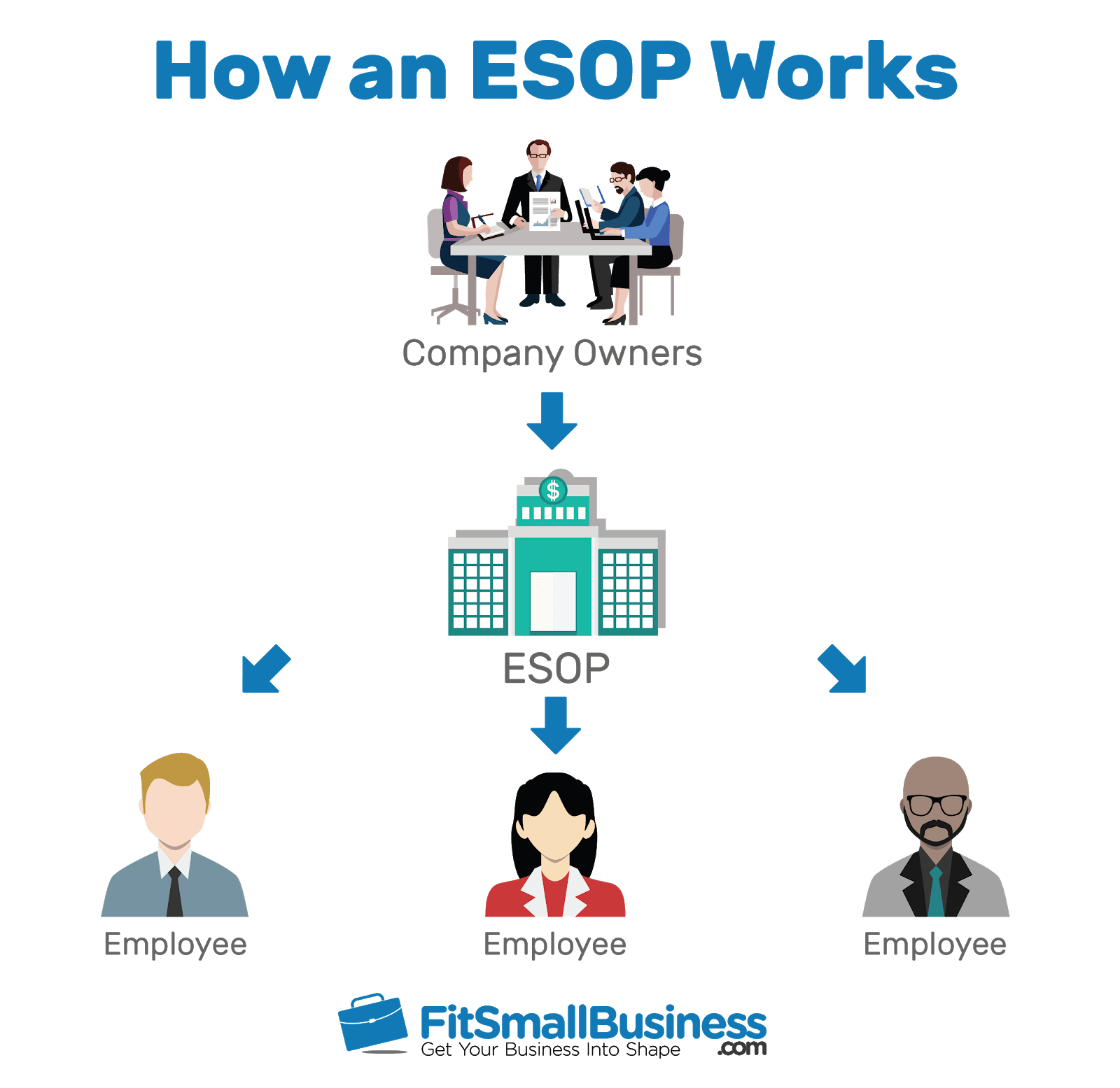

What exactly are employee stock options? A stock option is an offer by a company that gives employees the right to purchase a specified number of shares in the company at an agreed upon price usually lower than market value by a specific date.

The employee is under no obligation to purchase all or part of the number of shares noted in the option. The choice is theirs and they can normally purchase stock at any point during the time period between the offer and last exercise date. Certain types of stock options also provide employees with the ability to convert part or all of the potential compensation package into capital gains for tax purposes.

What are the pros of offering employee stock options? They are a cost-effective company benefit that can help make employment packages more attractive. From a human resources perspective, they may increase staff retention, as the vesting of stock option stipulates that require employees to remain employed for a certain period of time before the shares can be issued and sold. Employees can reap some of the financial rewards of a successful business, which increases dedication for all employees involved, as they are more invested in the company and its results.

They can serve as a sound investment for someone with a long-term financial strategy. Company stock options allow employees to invest without paying broker's fees. Company stock options pros and cons can offer some tax benefits.

What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value. Stock options can result in high levels of compensation of executives for mediocre business results, company stock options pros and cons.

An company stock options pros and cons employee must rely on the collective output their co-workers and management in order to receive a bonus. When do stock options work best? Stock options are most appropriate for small companies where future growth is expected, or for publicly owned companies who want to offer some degree of company ownership to employees. As previously stated, stock options should generally be used as an added incentive, and not as a substitute for a fair salary.

You've reached your limit - Register for free now for unlimited access To read the full story, just register for free now - GET STARTED HERE Already subscribed? Log in below. LOGIN Remember me. Free newsletter Our daily newsletter is FREE and keeps you up-to-date with the world of HR. Please complete the form below and click on subscribe for daily newsletters from HRD America.

SIGN UP. Fetching comments Millions lose aid after end of unemployment programmes. Walsh pays tribute to sacrifices of workers on Labour Day.

Amazon to recruit 40, new workers in September, company stock options pros and cons. Most Read Articles Google pushes back return-to-office plan to January 01 Sep Air New Zealand asks employee opinion on mandatory vaccines 01 Sep Amazon to recruit 40, new workers in September 02 Sep

What are Employee stock options (ESO)?

, time: 3:33Pros and Cons: Offering Employees Stock Options

maximization. These are not the only benefits of stock options, however. Other advantages can be summarized as follows: Alignment Of Interests One of the widely accepted advantages of using stock option compensation is that the agency conflict between managers and shareholders is reduced2 Highlights Workers are sometimes granted stock options as part of their annual pay. Employee stock ownership plans grow wealth on a tax-deferred basis. Company stock plans allow employees to invest without paying broker’s fees. Investing» The Pros And Cons Of Company Stock For many American workers, there are no words more magical than company [ ] 17/02/ · Company stock options allow employees to invest without paying broker's fees. They can offer some tax benefits. What are the cons of offering employee stock options? Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long blogger.comted Reading Time: 3 mins

No comments:

Post a Comment