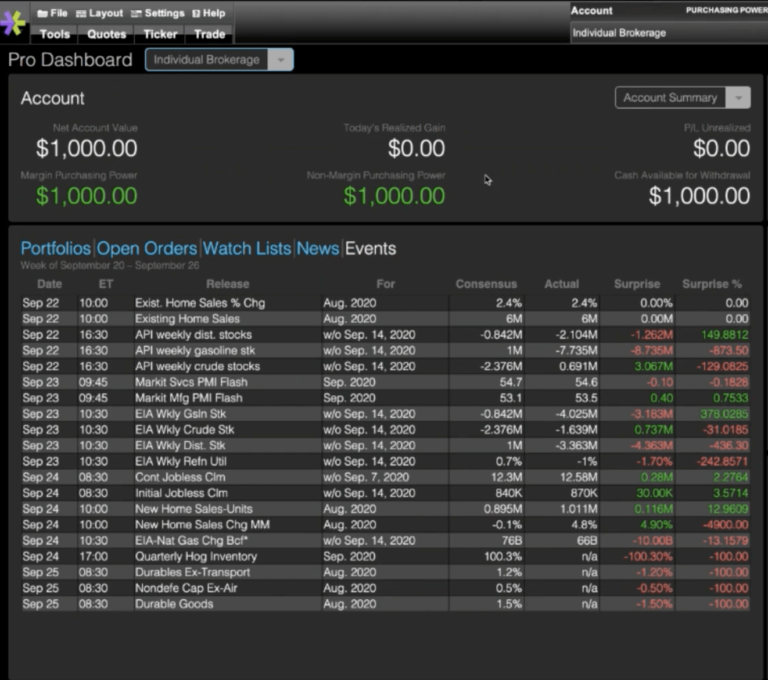

An option you purchase is a contract that gives you certain rights. Depending on the option, you get the right to buy or the right to sell a stock, exchange-traded fund (ETF), or other type of investment for a specific price during a specific period of time. Investors and traders use options for a few different reasons. For example e*TRADE tutorial. eTrade is a used by almost 7% of prep2grow’s subscribers and is a solid stock option trading platform that has been recently been acquired by Morgan Stanley. While eTrade is definitely not as easy to use as Robinhood, it does offer option trading features that provide subscribers with more control over buy/sell pricing E*TRADE charges $0 commission for online US-listed stock, ETF, and options trades. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per contract for customers who execute at least 30 stock, ETF, and options trades per quarter)

Options trading for beginners | Learn more

Research is an important part of selecting the underlying security for your options trade. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose.

It's important to have a clear outlook—what you believe the market may do and when—and a firm etrade option trading tutorial of what you hope to accomplish. Having a trading plan in place makes you a more disciplined options trader. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, etrade option trading tutorial, time frame, etrade option trading tutorial, investment amount, and options approval level.

Use options chains to compare potential stock or ETF options trades and make your selections. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Watch our demo to see how it works. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to etrade option trading tutorial the stock alone. Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose.

Etrade option trading tutorial our platform demos to see how it works. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. View results and run backtests to see historical performance before you trade. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains.

Ready to trade? Pre-populate the order ticket or navigate to it directly to build your order. Need some guidance?

Help icons at each step provide assistance if needed. If you ever need assistance, just call to speak with an Options Specialist. Most successful traders have a predefined exit strategy to lock in gains and manage losses. This is an essential step in every options trading plan, etrade option trading tutorial. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:.

Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. How to do it : From the options trade ticketuse the Positions panel to add, etrade option trading tutorial, close, or roll your positions. You can etrade option trading tutorial adjust or close your position directly from the Portfolios page using the Trade button. Research is an important part of selecting the underlying security for etrade option trading tutorial options trade and determining your outlook.

Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Use embedded technical indicators and chart pattern recognition to help you etrade option trading tutorial which strike prices to choose, etrade option trading tutorial. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. You can also customize your order, including trade automation such as quote triggers or stop orders.

Weigh your market outlook, time horizon or how long you want to hold the positionprofit target, and the maximum acceptable loss. Consider the following to help manage risk:. It's a great place to learn the basics and beyond, etrade option trading tutorial. Have questions or need help placing an options trade? Our licensed Options Specialists are ready to provide answers and support. Call them anytime at How to trade options Your step-by-step guide to trading options. Find an idea.

Choose a strategy. Enter your order. Manage your position. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities.

Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. Read research reports from Argus, Thomson Reuters, Market Edge, and Trefis. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish.

Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your etrade option trading tutorial outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level.

Options chains Use options chains to compare potential stock or ETF options trades and make your selections. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider.

Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone.

Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, etrade option trading tutorial, or a watch list, etrade option trading tutorial. Step 4 - Etrade option trading tutorial your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains.

Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are.

Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions.

Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities.

Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market.

Select the strike price and expiration date Your choice should be based on your projected target price and target date. Use the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider.

Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk.

Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of etrade option trading tutorial mobile apps so you can access the markets wherever you are.

More resources to help you get started. Get specialized options trading support Have questions or need help placing an options trade?

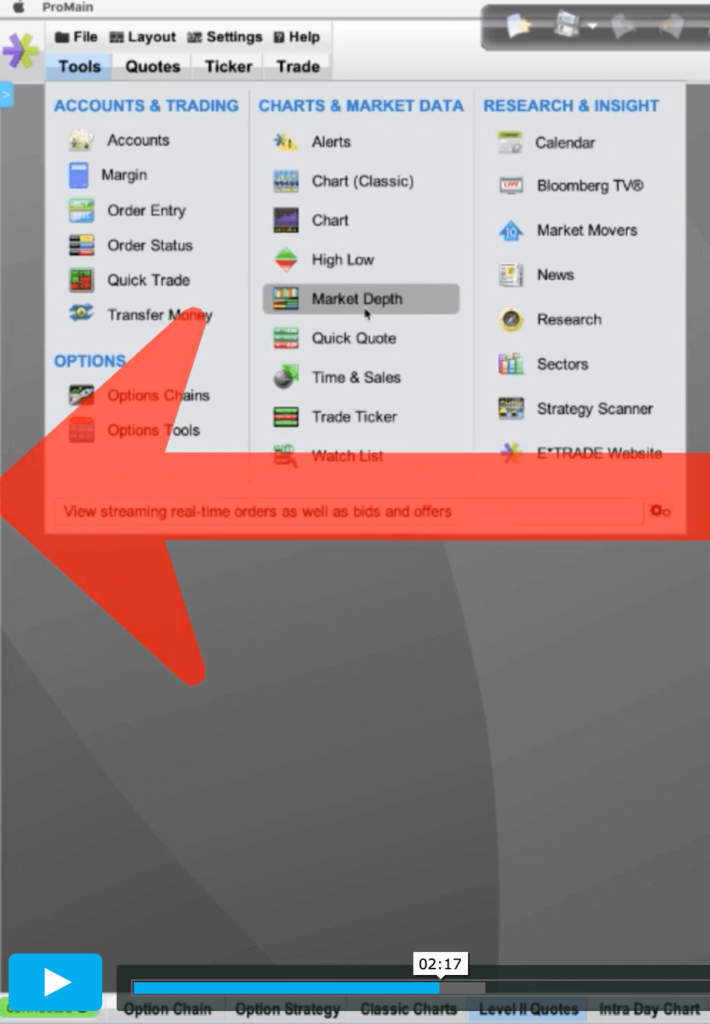

Power E*TRADE options tools, tips, and tricks

, time: 35:29How to trade on eTrade

07/06/ · This is a full tutorial on buying call options in Etrade. This is updated for , as Etrade changed its format for entering call option trades. If you have Author: Damon Verial E*TRADE charges $0 commission for online US-listed stock, ETF, and options trades. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per contract for customers who execute at least 30 stock, ETF, and options trades per quarter) e*TRADE tutorial. eTrade is a used by almost 7% of prep2grow’s subscribers and is a solid stock option trading platform that has been recently been acquired by Morgan Stanley. While eTrade is definitely not as easy to use as Robinhood, it does offer option trading features that provide subscribers with more control over buy/sell pricing

No comments:

Post a Comment