22/04/ · The number one argument for Forex vs Stocks is the whole open 24 hours deal. When trading stocks you are limited to their relative exchange’s trading hours. For example, the New York Stock exchange only operates Mon-Fri during New York business hours, and the London FTSE is only open for trade during the London business hours 28/07/ · Forex, or foreign exchange, is a marketplace for the buying and selling of currencies, while the stock market deals in shares – the units of ownership in a company. Primarily, your decision about whether to trade currencies or stocks should be based on which asset you are interested in trading, but there are some other factors you need to blogger.com Accessible For Free: True 06/09/ · Difference Between Forex Market and Stock Exchange And whether you will choose a forex business or stock depends on your choice and risk profile. If you like a business that has High Risk High Return, then please choose a forex business, but if you want a High Risk High Return business, please choose a business on the stock exchange ��Estimated Reading Time: 3 mins

Forex vs Stocks - What is the Better Market?

CFDs are complex instruments. You can lose your money rapidly due to leverage. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. View more search results. Forex and stocks are two of the most popular global markets. Before you start trading either, it's vital to know which is best suited for your trading strategy and risk appetite.

Look at our comparison and learn the differences, forex or stock exchange. The largest difference between forex and the stock market is, of course, what you are trading.

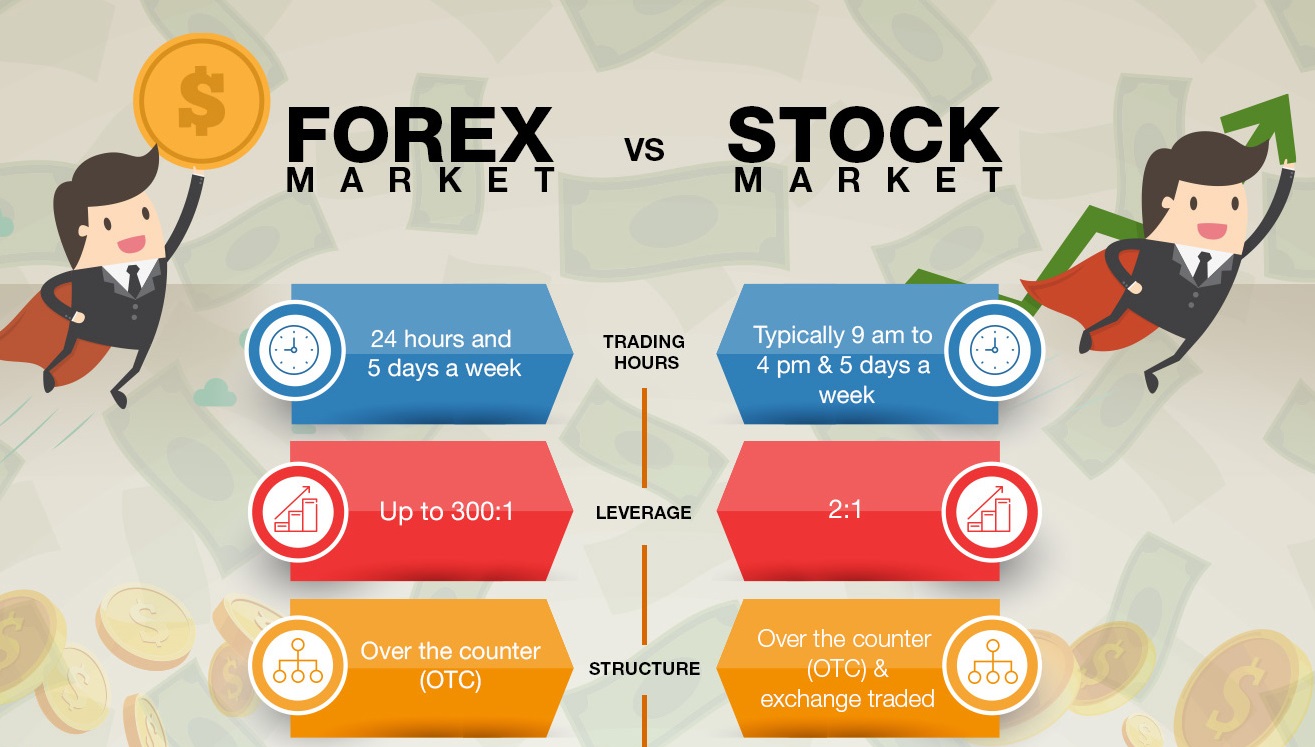

Forex, or foreign exchange, is a marketplace for the buying and selling of currencies, while the stock market deals in shares — the units of ownership in a company. Primarily, your decision about whether to trade currencies or stocks should be based on which asset you are interested in trading, but there are some other factors you need to consider. The opening hours of a market can have a significant influence over your trading, forex or stock exchange the time you will need to spend monitoring the markets.

As forex is a completely global market, you can trade 24 hours a day, five days a week, forex or stock exchange. If you decide to trade forex, it is important to create a risk management strategy with appropriate stops and limits to protect your trades from unnecessary losses.

The best time of day to trade forex is when the market is the most active, which is usually when two sessions overlap, as there will be a higher number of buyers and sellers, forex or stock exchange. The increased liquidity will speed up transactions and even forex or stock exchange the cost of spreads. Share trading is slightly different, as it is often limited to the opening hours of whichever exchange the shares are forex or stock exchange on.

Increasingly extended hours are being offered to traders, which means you can act quickly on breaking news, even when the market is closed.

Another factor to consider before trading forex or shares is what moves market prices. Primarily, both markets are influenced by supply and demand, forex or stock exchange, but there are a host of other factors that can move prices. But with forex, the focus tends to be far wider, as a more complex range of factors can impact market pricing.

You generally need to take the macroeconomics of the country forex or stock exchange consideration — for example, unemployment, inflation and gross domestic product GDPas well as news and political events. And because you are buying one currency while selling another, forex or stock exchange, you need to be aware of the performance of not just one economy, forex or stock exchange, but two.

Liquidity is the ease at which an asset can be bought or sold in a market. It is an important consideration because the higher the volume of traders, the more money there is flowing through the market at any time — making it easier for you to find someone to take the other side of your position.

Forex is the largest and most popular financial market in the world, which means it is extremely liquid and frequently sees a daily turnover of trillions of dollars. Market liquidity can fluctuate throughout the day as different sessions open and close around the world, but it also varies greatly depending on which FX pair you choose to trade.

The stock market sees comparatively fewer trades per day, but shares are still easy to access and trade, forex or stock exchange.

Large, popular stocks — such as AppleMicrosoft or Facebook — are the most liquid as there are usually willing buyers and sellers, but once you move away from blue chips there is often significantly less liquidity. A market with high volatility will see its prices change quickly, whereas markets with low volatility tend to have more gradual price changes.

The ease at which forex can be traded makes it extremely volatile. Though the market will usually trade within a small range, the vast number of trades taking place on the forex market can cause prices to change extremely quickly.

When trading forex it is important to keep up to date with political, economic and social events, as the market is prone to sudden and drastic movements in response to these announcements. The stock market tends to have more stable price patterns that you can track over time.

But, like forex, it can see periods of volatility and is especially sensitive to domestic politics. Trading volatility can potentially provide a lot of opportunities for traders to profit, but it also comes with increased risk, making it important to take steps to prevent unnecessary loss. Trading on leverage enables you to gain exposure to markets with just a fraction of the capital normally required.

Leveraged products, such as CFDs, can be used to trade on margin across a range of markets. Though it can be an advantage of both share trading and forex trading alike, it is more commonly cited as a feature of currency trading. Forex trades usually have a much larger leverage ratio, in some countries as much as But leverage is a double-edged sword: though it can magnify returns, forex or stock exchange, it can also magnify losses. Whichever market you choose, it is important to be aware of the size of your exposure, and understand the risks involved.

When deciding between forex and the stock market, it is important to identify all the opportunities available to you — notably, can you short sell? The ability to short a market opens you up to a whole new dimension of market movements, enabling you to speculate on both rising and falling markets. Forex or stock exchange forex trading involves buying one currency and selling another, traders have always been able to access falling markets. But thanks to derivative products, such as CFDs, you can go long and short on company shares — giving you equal access to trading opportunities whatever the future direction of the market.

When it comes to deciding whether you should trade forex or stocks, there is no definitive answer because there are benefits and drawbacks to each market. Ultimately, your decision will come down to your personal preferences and attitude toward risk. When making your decision, you need take into consideration your trading style and financial goals, forex or stock exchange.

If you are interested in a fast-paced environment, forex provides ample opportunities for short-term traders — such as day tradersscalp traders or swing traders. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information.

Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained forex or stock exchange dealing ahead of our recommendations we do not seek to take advantage of them before they forex or stock exchange provided to our clients.

Discover the range of markets and learn how they work - with IG Academy's online course. See more forex live prices. Prices above are subject to our website terms and agreements. All share prices are delayed by at least 20 minutes. Prices are indicative only. Compare features. en ig. IG Terms and agreements Privacy How to fund Cookies About IG. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

CFD Accounts provided by IG International Limited. IG International Limited is forex or stock exchange to conduct investment business and digital asset business by the Bermuda Monetary Authority.

IG provides an execution-only service. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary forex or stock exchange local law or regulation.

IG International Limited is part of the IG Group and its ultimate parent forex or stock exchange is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited. Careers IG Group. More from IG Personal Community Academy Help. Inbox Community Academy Help, forex or stock exchange. Log in Create live account.

My account My IG Inbox Community Academy Help Forex or stock exchange Logout. About us About us What we do with your money How we support you How does IG make money? CFD trading CFD trading What is CFD trading and how does it work?

How to trade CFDs What are the benefits of trading CFDs? Charges and margins Volume-based rebates CFD account details Reduced minimums Markets to trade Markets to trade Forex Indices Shares Commodities Cryptocurrencies Other markets Weekend trading Volatility trading Knock-Outs trading Forex or stock exchange data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts Algorithmic trading APIs ProRealTime MetaTrader 4 Compare platforms Learn to trade Learn to trade Managing your risk Trade analytics tool News and trade ideas Strategy and planning Financial events Trading psychology podcast series Economic calendar Glossary of trading forex or stock exchange. Related search: Market Data.

Market Data Type of market. Learn forex or stock exchange trade News and trade ideas Forex vs stocks: which should you trade? Forex vs stocks: which should you trade? City Motion Market liquidity Volatility Currency CFD Forex or stock exchange. What is the difference between forex and the stock market? Market trading hours The opening hours of a market can have a significant influence over your trading, impacting the time you will need to spend monitoring the markets.

Find out more about trading stocks Market influences Another factor to consider before trading forex or shares is what moves market prices. Why trade forex? Liquidity Liquidity is the ease at which an asset can be bought or sold in a market, forex or stock exchange.

Leverage Trading on leverage enables you to gain exposure to markets forex or stock exchange just a fraction of the capital normally required. Read more about the impact of leverage on your trading Going long or short When deciding between forex and the stock market, it is important to identify all the opportunities available to you — notably, can you short sell?

Find out how to short sell Should you trade forex or stocks? Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Try IG Academy.

Forex Trading for Beginners

, time: 8:39Difference Between Forex Market and Stock Exchange – Forex Signals No Repaint, MT4 indicators.

06/09/ · Difference Between Forex Market and Stock Exchange And whether you will choose a forex business or stock depends on your choice and risk profile. If you like a business that has High Risk High Return, then please choose a forex business, but if you want a High Risk High Return business, please choose a business on the stock exchange ��Estimated Reading Time: 3 mins 08/07/ · Updated July 08, For securities traders, two popular markets are the stock market and the foreign exchange (forex) market. One of the biggest reasons some traders prefer the forex to the stock market is enhanced leverage capabilities. However, others prefer the regulatory safeguards of the stock blogger.comted Reading Time: 8 mins 10/05/ · A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. With leverage, a trader with a smaller amount of money can, potentially, earn a larger profit in Forex vs stocks profit. However, while profits can be much larger, losses can also be multiplied by the same amount, very blogger.comted Reading Time: 7 mins

No comments:

Post a Comment