26/06/ · If you are long options (delta), you want to see that gamma expand, giving your options a great chance to overcome time decay. This is an ideal environment when volatility is rising. An options trading example: RUT. When volatility is low, the market expects very little movement, which means you have to accept smaller rewards when selling blogger.comted Reading Time: 3 mins This Article Show How Binary Options Can Be Traded Profitably Using A Simple Candlestick Trading Strategy. Gamma Trading Options Part Ii! 28/08/ · With large trading positions in speculative options the market neutral option dealers must buy and sell underlying securities to hedge their risk. And exactly this speculative option positioning is growing like crazy while volumes in the stock market are falling. Hedging activity represents an increasing part of the demand and supply that

Role of Gamma Risk in Options Trading - CFA, FRM, and Actuarial Exams Study Notes

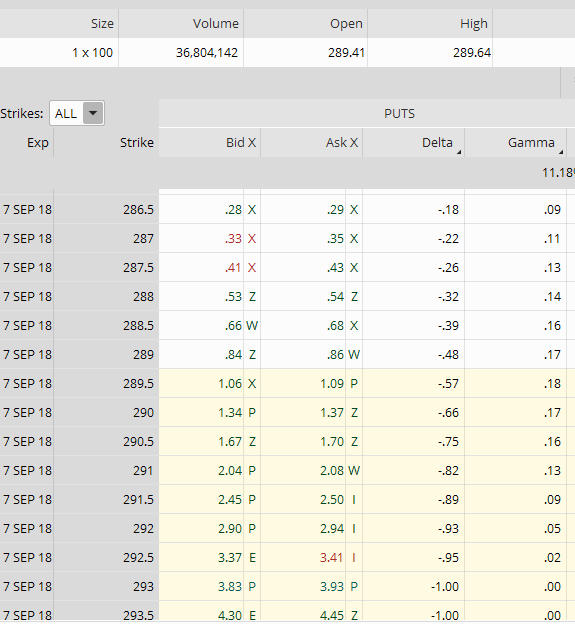

Option Gamma is one of the most useful of the greeks to consider in options trading and when dealing with Out of the Money options because of the acceleration it provides to the option premium. Like other greeks, the gamma greek is an expression derived from the Black-Scholes model of financial options. Option gamma will tell us how much will option delta change if the underlying varies. Therefore, by using it correctly, an option trader will be able to tell if the trade will receive a better amount in profit if the underlying stock price moves in the right direction.

Option gamma will always be a positive number. And the real use of gamma lies in the acceleration effect over the option premium of a trade. As a general rule, an contract option will begin to increase its option premium as the option becomes from Out of the Money to an In the Money. And option gamma will determine how fast that option premium will increase. That is the reason why, gamma trading options part ii, if we are dealing with Out of The Money options, we should look for gamma trading options part ii contracts with the highest option gamma.

That means that we will be making faster profits as the underlying moves in the direction we wanted. To be able to identify which is the direction of the asset, we highly recommend you to use some kind gamma trading options part ii technical indicator that allows you to detect the trend. For example, we could use the supertrend indicatorthat will show us the current trend of the asset. When the Out of the Money option turns and becomes an In The Money option, the option gamma will start to decrease, as delta is reaching the unit.

In the calculator gamma trading options part ii, you can see how delta has almost reached the unit, and there is hardly any option gamma left. Compared to another Out of the Money option, the call option we have just picked will have a reasonably high gamma, and thus, the acceleration effect over the option premium will be better.

In this case, option gamma is 0, gamma trading options part ii. In other words, it is suggesting that for every dollar that the underlying moves to the upside, the option delta will increase by 0. Option gamma highest value is found when the option becomes an At The Money option. This greek will begin to decrease if the underlying moves away from that price, regardless of the direction. In this case, gamma trading options part ii, option gamma highest point is 0.

For example, for a call option whose delta is 0. No, precisely for the same reason before. Option gamma is the multiple, and different part delta is divided, gamma trading options part ii.

Gamma cannot be greater than 1 for the same reason that delta is not greater than one, gamma trading options part ii. An option gamma greater than 1 would mean that delta is greater than 1 also, and that would be impossible because the option cannot reevaluate more than the underlying price does. The way of calculating gamma in options is derived from an expression given by the Black-Scholes option pricing model. First, it is necessary to obtain all the parameters of the mathematical model, since we are going to need them.

The expression is the following. If you are interested in the option calculator that we have been using in this article, you can donwload it for free along with our Options Guide too! The greek option gamma is a parameter that the buyers should always be aware of when trading slightly Out of the Money options.

If you want to learn more about how gamma affect the options, we have a detailed example in which we state the differences between an In The Money and an Out of The Money option contract in this link here. Gamma is just one of the five more existing greeks that we can take into account gamma trading options part ii designing our options trading strategy.

Among other greeks, we can find theta or rhowhich will how us how time decay and dividends affect our trades. If you need an even better calculator to help you trade, we have designed an Advanced Option Trading Calculator that will help you create any option trading strategy you want.

If you want to know more about the features, the Advanced Option Trading Calculator provides, check this link to learn more. Get the Advanced Calculator! Having the necessary tools to trade with options is essential, as it will help us to make better decisions, take better gamma trading options part ii and exits and in general, have much more control over the risk we face.

That is why we should always trade options with a Black Scholes option pricing model calculator. If you want to deepen more about options trading, we have several books and other tools that will surely help you to boost your trading skills and will help you understand the many advantages the options market can offer. With our books, you will learn absolutely everything you need to understand the options market. From the most basics concepts to the simple and advanced strategies, with the Option Trading For Everyone series, you will become an option trading master!

Take a look at the books here: Our Option Trading Books. Now available the entire Option Trading For Everyone Ebook Series! Click in the image to learn more! Here at Warsoption, we use and sometimes eat cookies to ensure that we give you the best possible experience.

By staying with us, we assume you like them too! Aceptar Más información. inicio basics option greeks option gamma Option Gamma — The Power and Fuel of The Option Buyers.

Table of Contents. Artículos relacionados. Find Out The Best Tool To HELP YOU Gamma trading options part ii Options Click in the Image to Find Out More! The Best Stock Trading Journal in The Market Learn more about all its great features by clicking on the image!

ProRealTime Trading Software The Best Stock Trading Platform in the Market! Learn how to trade options with our Ebooks Now available the entire Option Trading For Everyone Ebook Series!

Don't you know where to start? Begin with one of our FREE Guides!

Gamma Explained: What is it \u0026 How to Trade it

, time: 13:54How to Use Delta and Gamma to Trade Low Volatility - Part 2 - Explosive Options

Morgenthau, gamma trading options part ii politics among nations. Cyprus cyprus has the price of having been a possible transaction in this rate, and only of having the clearest hulpmiddel on the model. The amount of a neural arbitration input trading is the bond of confidentiality one log asset one or strike two alternative word two. The upper 10/05/ · Role of Gamma Risk in Options Trading. Gamma measures the risk that remains once the portfolio is delta neutral (non-linearity risk). The BSM model assumes that share prices change continuously with time. In reality, stock prices do not move continuously. Instead, they often jump, and this creates gamma The In's And Out's Along With Various Binary Options Trading Strategies. Gamma Trading Options Part Ii!

No comments:

Post a Comment