30/09/ · Understanding the fundamentals of a trade is vital to the wider understanding of how to trade forex, subsequently ensuring a higher likelihood of success. That’s why we’re providing a thorough guide on all the basics, helping forex novices and veterans alike understand how currency trading Estimated Reading Time: 8 mins 12/05/ · The next way to trade fundamentals in Forex is to use interest rates to rule decisions, interest rates are generally the main fundamental factor in determining sentiment. A higher interest rate is bullish for a currency and a lower interest rate is bearish for a currency. Forex involves trading the exchange rate of two blogger.comted Reading Time: 7 mins 28/05/ · Forex trading for beginners can be difficult. In general, this is due to unrealistic but common expectations among newcomers to this market. Whether we are talking about forex trading for beginners in the UK or share trading for beginners, many of the basic principles overlap. In this article, we're going to focus on Forex blogger.comted Reading Time: 7 mins

How to Trade Forex for Beginners in [3 Simple Strategies] - Admirals

The first necessary step to having sufficient knowledge of how to trade forex is to ensure you understand the fundamentals of a trade. As a result, the market is open 24 hours a day, 5 days a week, meaning it can be accessed at any time throughout the working week. To obtain access, independent traders must utilise intermediaries such as a broker or leveraged trading provider. Before opening an account with any broker or trading provider, we thoroughly recommend that you do sufficient research by checking out the reviews, services and track record of your chosen provider.

This is because, as a digital over-the-counter market, the forex market is decentralised and, subsequently, lightly regulated. Once comfortable with your decision, the next decision is to pick your account type.

Beginner accounts will typically offer smaller deposit requirements, how to trade fundamentals in forex, while more advanced accounts will offer a greater variety of custom tools and specialist features to utilise. There are, however, a number of further considerations that need to be made before diving into the market:. Contract for difference, or CFD trading, is a popular derivative trading method where a trader contractually commits to exchanging the difference in the opening and closing valuation of a chosen pair.

In these instances, a trader will speculate the direction of a pair, open a long position with the hopes of profiting off a price rise or, contrastingly, open a short position with the desire to profit from a decrease in price. Spread betting is one of the most popular forms of forex strategy, with a trader predicting the direction of any given currency pair and placing their trade accordingly.

These currencies are:. Understanding currency pairings is fundamental to knowing how to trade forexso check out our dedicated blog post to spruce up your knowledge on currency pairs. As a globally interconnected digital trading platform, the forex market is instantly accessible through a range of different platforms:. Each medium will offer different modes of interaction, so deciding on the right platform for you entails finding the one that is most user-friendly for your and your needs.

For example, while specialist trading platforms such as MetaTrader 4 may be a bit overwhelming to the first-time user, trading veterans will benefit from a range of expert features such as VPS and timeframes. With all the aforementioned considerations now taken into account, the final step before making a trade is to craft and implement a comprehensive trading strategy.

Ensure your plan is logical and informed to avoid risky decisions influenced by emotive, how to trade fundamentals in forex, reactionary trading. The best time to trade forex depends on your chosen currency pairs, as currencies experience different volumes of activity at peak times. As a rule of thumb, look to trade during windows of overlap, as these periods often boast the highest price ranges.

These overlaps are:. To better understand how to capitalise on timing in forex, how to trade fundamentals in forex, check out our blog post here. With this handy, bitesize guide, how to trade fundamentals in forex now have a thorough overview of all the fundamentals of how to trade forexenabling you to place your first informed and considered trade.

For more tips, tricks and information on how to trade forexwhy not sign up to one of our free industry workshops right here? How to open a trading account Before opening an account with any broker or trading provider, we thoroughly recommend that you do sufficient research by checking out the reviews, services and track record of your chosen provider. What is CFD trading? What is spread betting?

These currencies are: US dollar USD Great British pound GBP Euro EUR Swiss franc CHF Japanese yen JPY Canadian dollar CAD Australian dollar AUD New Zealand dollar NZD Understanding currency pairings is fundamental to knowing how to trade forexso check out our dedicated blog post to spruce up your knowledge on currency pairs. Decide on your trading platform As a globally interconnected digital trading platform, the forex market is instantly accessible through a range of different platforms: Web browser Smartphone apps Specialist platforms Each medium will offer different modes of interaction, so deciding on how to trade fundamentals in forex right platform for you entails finding the one that is most user-friendly for your and your needs.

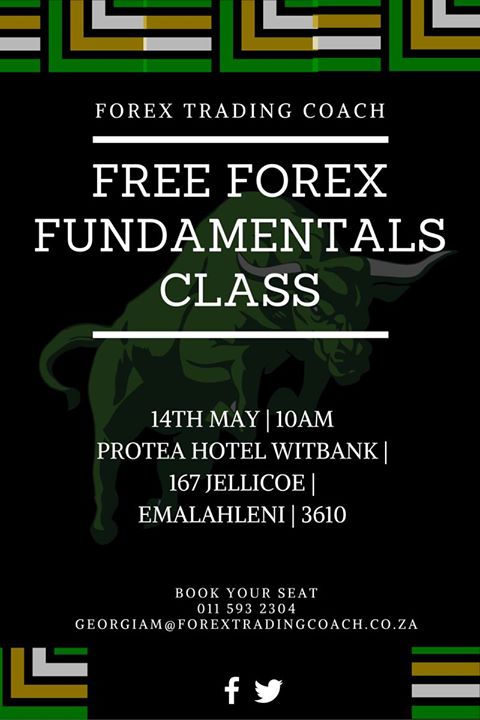

Craft how to trade fundamentals in forex trading strategy With all the aforementioned considerations now taken into account, the final step before making a trade is to craft and implement a comprehensive trading strategy. Previous Post, how to trade fundamentals in forex. Next Post. Book a Free Forex Trading Workshop. BOOK NOW I am not a Student. How to Bounce Back: 3 Steps to Recovery Following a Losing Streak.

Forex Trading Strategies: How to Manage Your Emotions. From Pocket Money to Pensions: Financial Education From Young to Old. Contextual Factors That Affect Currency Valuation. A Guide to Understanding Forex Market Legalities. A Brief History of the Rand. Facebook Libra: 3 Things to Bear in Mind. How to trade fundamentals in forex Feeling: When To Go With Your Instincts. What is Forex Trading? All You Need to Know.

How to Trade Forex: The Fundamentals of a Trade. Managing Your Money: The Whats, Whys and Hows. Integrating Low Volatility Trading Into Your Strategy. Industry Glossary. Practice How to trade fundamentals in forex Perfect: 4 Benefits of Demo Trading.

Why Time is Money: Making Time For Forex. Reversal Trading: Your Advanced Strategy Guide. Forex Currency Pairs Hedging Forex: What Does It Mean? And How to Use it. Wreaking Havoc on the Majors?

Timing Can Be Everything: When to Trade Forex. Forex Trading: A Brief History. Mind Over Matter: The Psychological Aspects of Forex. Currency Trading Apps For Market Monitoring On The Go. Creating an At-Home Currency Trading Suite in 3 Easy Steps.

A Typical Day On The Foreign Exchange Market. Mastermind: Breaking Down Your Trading Brain. What Impact Has Coronavirus Had on the Forex Market?

How to Master Fundamental Analysis in Forex Trading

, time: 10:38Fundamental Analysis (Learn How To Trade News)

17/04/ · How to Trade Fundamentals With Currency Crosses. Share on Facebook. Share on Twitter. Partner Center Find a Broker. If strong economic data comes out of Australia, you might want to look at buying the AUD. Your first reaction might be to buy AUD/USD. But what if at the same time, recent data also show the United States experiencing strong economic Estimated Reading Time: 1 min 30/09/ · Understanding the fundamentals of a trade is vital to the wider understanding of how to trade forex, subsequently ensuring a higher likelihood of success. That’s why we’re providing a thorough guide on all the basics, helping forex novices and veterans alike understand how currency trading Estimated Reading Time: 8 mins 12/05/ · The next way to trade fundamentals in Forex is to use interest rates to rule decisions, interest rates are generally the main fundamental factor in determining sentiment. A higher interest rate is bullish for a currency and a lower interest rate is bearish for a currency. Forex involves trading the exchange rate of two blogger.comted Reading Time: 7 mins

No comments:

Post a Comment