Every trader should invest their time and learn these patterns as it will provide a deeper knowledge and understanding of reading forex charts in general. Candlestick patterns can help you interpret the price action of a market and make forecasts about the immediate directional movements of the asset blogger.comted Reading Time: 9 mins 07/12/ · Candlestick charts are the most popular charts among forex traders because they are more visual. Candlestick charts highlight the open and Author: David Bradfield 16/07/ · The three main chart types are line, bar, and candlesticks. For forex traders, candlestick charts seem to be the crowd favourite, and it’s easy to see why. Compared to a line chart, which shows the price close to close, candlestick charts show four times the amount of information, displaying the close, open, low and high price of a given period

Learn How to Read Forex Candlestick Charts Like a Pro - Forex Training Group

Japanese candlestick charts, or Forex candlestick charts, offer traders a greater depth of information than traditional bar charts.

They provide different visual cues that make understanding price action easier and allow traders to spot Forex patterns more clearly. In this article, we will tell you everything you need to know about candlesticks, list some common Forex candlestick patterns that you should look out for when trading, provide an example of a trading strategy which utilises these candlestick patterns and much more!

In the picture above, we can see two examples of Forex candlesticks, understanding forex candle charts. The 'body' comprises the difference between the opening and closing price and the lines either side nose and tail represent the highest and lowest prices of the time period. Generally speaking if the Forex candle body is black, as shown above, or red, then the closing price is lower than the opening price - this is understanding forex candle charts to as a bear candle.

On the other hand, a white or green body indicates that the closing price is higher than the opening price - this is referred to as a bull candle. A price closing where it opened, or very close to where it opened, is called a Doji candle.

Memorising Japanese candlestick names and descriptions of Japanese candlestick trading formations is not a prerequisite for successful trading. Nevertheless, it is helpful for price action traders.

By looking at Forex candlesticks, traders can see momentum, direction, now-moment buyers or sellers, and general market bias. Depicted: Admirals formerly Admiral Markets MetaTrader 5 - GBPUSD Daily Chart. Date Range: 26 January - 20 August Date Captured: 20 August Past performance is not a reliable indicator for future results, understanding forex candle charts.

The high of a Forex candlestick acts as a resistance, while the low acts as a support. The bigger the candle, the stronger the levels of support and resistance are especially with the Master Candle pattern — which we will cover later in the article. Depicted: Admirals MetaTrader 5 - AUDUSD H1 Chart. Date Range: 3 August - 6 August It shows you crucial Forex candlestick data you need to know, including the high and low, as well as the open and close price, understanding forex candle charts.

Candles that open at the low, close at the high or candles that are extremely long are a common occurrence. If there is a long downtrend, such a candle indicates a major trend reversal is occurring. On the contrary, after a long uptrend, if an unusually long candle closes, that would show a long wick to the upside, or a strong bearish body right from the top, then we are talking about exhaustion or a 'blow off-top condition'. Depicted: Admirals MetaTrader 5 - USDCHF H4 Chart. Date Range: 15 June - 23 August Date Captured: 23 August In bullish market conditions, or during a strong uptrend, buying will usually occur on the open.

The price should rise, understanding forex candle charts, and a hollow, green candle is formed. As the bulls control the price action in the market, the length or the distance between the open and the close reflects their dominance.

In bearish market conditions, or during a strong downtrend, a red body candle should form. This represents sellers entering the market on the open, and dominating that particular time. Forex candlestick charts allow for great analyses from the shape and colour understanding forex candle charts the body of the candle, in comparison with bar charts. If we see long tails, or shadows, formed at the bottom of the body, an important factor to consider is whether they form understanding forex candle charts a long downtrend.

This indicates the potential for the trend to exhaust itself, and that the demand is increasing or that the supply is dwindling, understanding forex candle charts. If we have tails, or shadows, formed at the tops of real bodies, especially after a long price rise, understanding forex candle charts, this indicates that the demand is drying up, and that the supply is increasing, understanding forex candle charts.

The larger the shadow, the more important it is to analyse it in relation to the real body, as this may signify the strength of the reversal.

The strongest of those are pins. In the image above, the bullish pin bar's tail is pinning down, rejecting support. This is Indicated by the bullish pin and we should see a surge of 'now-moment buyers' and, consequently, the price would increase. Understanding forex candle charts, when a bearish pin bar's tail is pinning up, and rejecting resistance, we would see a surge of 'now-moment sellers', and the price would usually decrease.

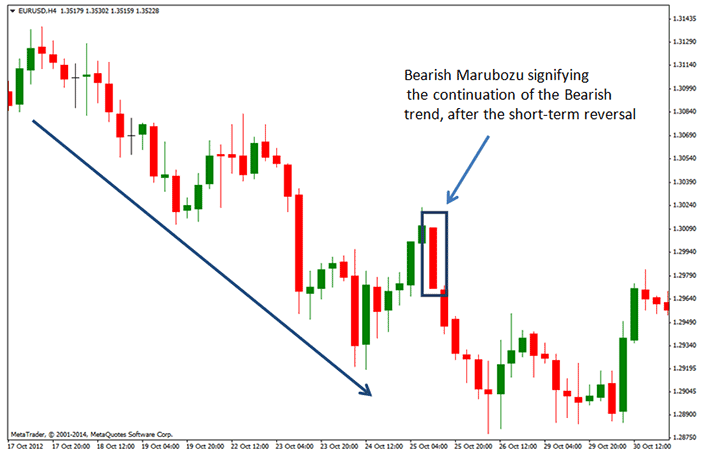

The strongest reversal candles have wicks that are much longer than the bodies, and a very small nose or no nose at all. Depicted: Admirals MetaTrader 5 - USDCHF H1 Chart. Date Range: 18 August - 23 August Strong momentum Forex candlesticks, which usually open either at a support or a resistance level are called Marubozu candles.

The Marubozu candle is a momentum candle with either a small, or no, tail. This type of Forex candlestick pattern is really powerful and means a lot in regard to price movement. The Marubozu candle defines a strong selling-off resistance or a strong understanding forex candle charts support. Marubozu means 'bald head' or 'shaved head' in Japanese. This is because such a candle does not have at least one shadow, understanding forex candle charts, or the shadow is very small.

In modern market trading, a Marubozu candle can also have a very small wick on both sides, and may still be considered valid. That is why the term momentum understanding forex candle charts is used. A Bullish green Marubozu candle appearing in an uptrend may suggest a continuation, while in a downtrend, a Bullish Marubozu candle can signify a potential bullish reversal pattern.

Depicted: Admirals MetaTrader 5 - USDJPY H4 Chart. Date Range: 5 August - 23 August Conversely, the Bearish red Marubozu candle appearing in a downtrend may suggest its continuation, while in an uptrend, a Bearish Marubozu candle can signify a potential bearish reversal pattern. Depicted: Admirals MetaTrader 5 - EURUSD H4 Chart. If you are a beginner trader looking for a place to learn about Forex trading, our Forex Online Trading Course is the perfect place for you!

Learn how to trade Forex in just 9 lessons, guided by a professional trading expert. Click the banner below to register for FREE! Forex candlestick patterns occur very often in the Forex market, understanding forex candle charts is a list of some of the most common ones:.

Of course, there are many more Forex candlestick patterns, but in this article, we will be paying attention to the most popular ones. In the next few sections, we have compiled a cheat sheet for you to help you recognise the most common candlestick patterns!

Depicted: Admirals MetaTrader 5 - GBPUSD H1 Chart. Date Range: 9 August - 12 August It is a bullish reversal candlestick pattern which appears at the bottom of downtrends. The hammer candle body can be either bullish or bearish, but it is considered to be stronger if it's bullish. Depicted: Admirals MetaTrader 5 - USDCAD H4 Chart. The Shooting Star candle appears in uptrends, signifying a potential reversal.

The wick is long, upside, and longer than the body. The Shooting Star candle body can be either bullish or bearish, but it is considered to be stronger if it is bearish. Depicted: Admirals MetaTrader 5 - GBPJPY H1 Chart. The Hanging Man candlestick is similar to the Hammer candle, but it occurs at the top of uptrends, and can act as a warning of a potential downward reversal, understanding forex candle charts.

Depicted: Admirals MetaTrader 5 - EURGBP H1 Chart. Date Range: 13 August - 18 August The Piercing Line candle is a bullish reversal candlestick pattern. It is very common in the Forex market. This Forex candlestick pattern occurs when the second bullish candle closes above the middle of the first bearish candle.

The second candle's open is lower than the first candle's close. In the Forex market, the pattern is valid understanding forex candle charts if the second candle's open is equal to the first candle's close. The Dark Cloud Cover candle is a bearish reversal pattern that shows in uptrends. It consists of two candles. The first one is bullish and the second one is bearish. The Dark Cloud Cover candle is formed when the second candlestick opens above the close of the first candlestick, but then drops and closes above the open price of the first candlestick.

This pattern is the opposite of the Piercing Line. Similarly, in the Forex market, the Dark Cloud Cover candlestick is valid even when the second candlestick opens at the close of the first candlestick.

Date Range: 10 August - 13 August Bullish and bearish engulfing candles are reversal patterns. A bullish engulfing candle usually occurs at the bottom of a downtrend, whilst a bearish engulfing candle is spotted at the top of an uptrend. The bullish engulfing candlestick pattern is characterised by the two candles. The first one is contained within the real body of the second candle, which is always bullish.

The bearish engulfing candlestick pattern is also characterised by two candles. The first one is contained within the real body of the second candle, which is always bearish. Date Range: 4 August - 23 August Date Range: 13 August - 23 August The Master candle candlestick pattern is a concept known to most price action traders.

The Master candle is defined by a pip candlestick that engulfs the next four Japanese candlesticks. The breakouts of the Master candle can be traded if the 5th, 6th, or 7th candlestick break the range in order for a breakout trade to become valid. Date Range: 16 August - 19 August This is a great Forex candlestick pattern formation that you should check for on a regular basis when trading.

HOW TO READ CANDLESTICK CHARTS FOR BEGINNERS 2021 - UNDERSTANDING CANDLES IN DAY TRADING

, time: 9:31Easy Ways to Read a Candlestick Chart: 12 Steps (with Pictures)

17/12/ · Forex candles, or the candlestick chart, are OHLC charts, which means that each candle shows the open, high, low, and close price of a trading period. This is represented by the following picture. The solid body of a candlestick shows the open and close prices of a trading period, while the upper and lower wicks of the candle represent the high and low prices of that trading blogger.comted Reading Time: 6 mins 30/09/ · A candlestick chart is a type of financial chart that shows the price action for an investment market like a currency or a security. The chart consists of individual “candlesticks” that show the 94%(84) Every trader should invest their time and learn these patterns as it will provide a deeper knowledge and understanding of reading forex charts in general. Candlestick patterns can help you interpret the price action of a market and make forecasts about the immediate directional movements of the asset blogger.comted Reading Time: 9 mins

No comments:

Post a Comment