In very simple terms options trading involves buying and selling options contracts on the public exchanges and, broadly speaking, it's very similar to stock trading. Whereas stock traders aim to make profits through buying stocks and selling them at a higher price, options traders can make profits through buying options contracts and selling them at a higher price 08/06/ · For example, as we saw above, to buy a RIL call option with a strike price of , the trader needs to pay only Rs 50 per share rather than Rs per share Potential for unlimited profit: When a trader buys either a call or put option, there is potential for unlimited profit if the share price moves in the right direction 09/09/ · Download the Options Trading eBook. Breakeven Price. The breakeven price for a short call option strategy is the short call strike plus the premium received. For example, if a stock is trading at $ and the trader sells a $ call option for a premium of $, the breakeven price would be $

7 Best Options Trading Examples • • Benzinga

Vanilla options or plain vanilla options give traders the right to buy or sell forex and other assets at a predetermined price in the future. This article covers definitions and types, including European style options, plus the strategies used to execute trades.

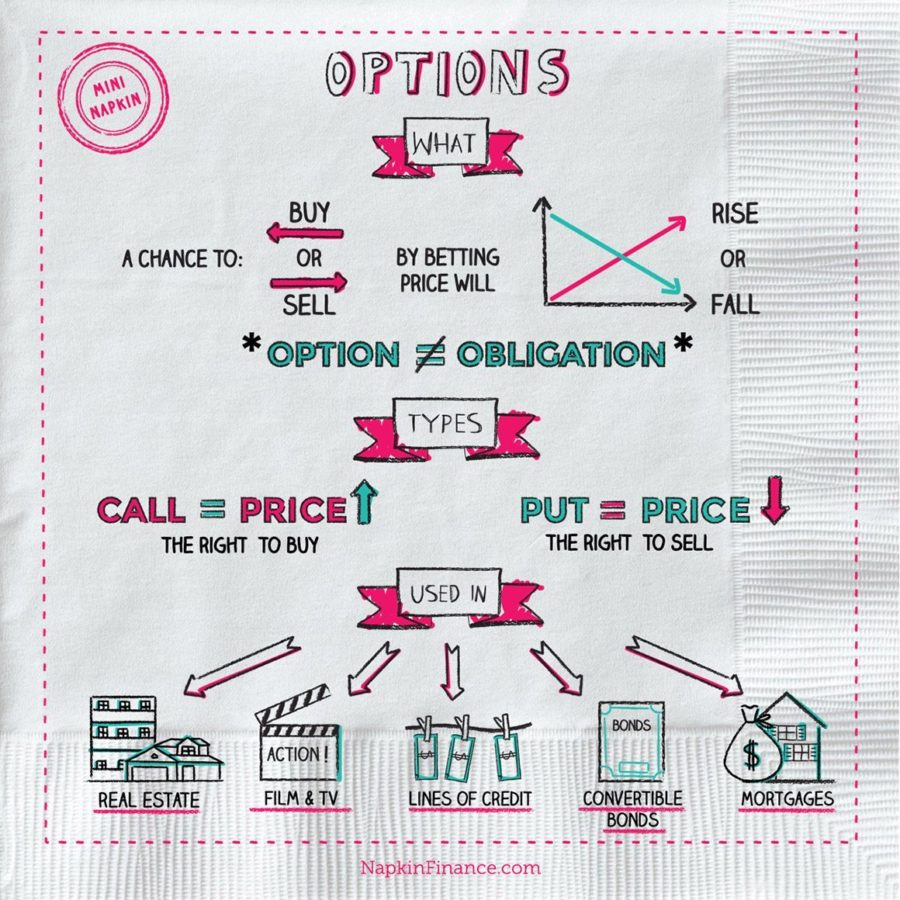

A plain vanilla option is a financial instrument that allows holders to buy or sell an underlying asset, at a prearranged price within a given period. The holder owns the right to the transaction but does not necessarily have the obligation to exercise it. The broker acts as the pricer. There are different types of vanilla options that you can trade, for example, FX currency options, index options, swap and strip options, plus bond options.

What is options trading example can find vanilla options trading at many UK-based and worldwide brokers, including IG, LCG, Avatrade, and easyMarkets. Vanilla options consist of two types: call and put options. Call option holders have the right to buy the underlying asset at a predetermined price.

This is known as the strike price. Put option holders have the right to sell the underlying asset at the same strike price and time frame. The time frame is determined by the expiry date, which sets a time limit on the movement of the asset. The seller of the option is known as the writer, who is then obligated to buy or sell the asset, should the holder exercise their right to do so. An option is in the money if the strike price is higher than the market price of the underlier at the date of maturity.

At this point, what is options trading example, the option can be exercised by the owner. There are several types of trading options that depend on being in the money. European style options need to be in the money at the expiry date in order to be exercised. The point at which an option moves into the money is when it gains intrinsic value.

American style options, however, can be exercised if it is in the money on or before the date of maturity. A premium is also paid by the owner to own the option and is based on the value of the underlier, the time left until expiry, and the volatility of the underlier. If any of these factors increase, what is options trading example, the premium will subsequently increase.

Options premiums can also be affected by interest rate changes and cash dividends. Some traders, however, prefer to what is options trading example the volatility, rather than the price, what is options trading example.

This volatility trading strategy assumes that more volatile assets have an increased chance of being in the money. This is why vanilla options are often quoted in terms of implied volatility. Vanilla options can also be combined with other types of options, which can create tailored outcomes. Exotic options, for example, are based on certain conditions that need to be met prior to execution and settlement. Exotic options are generally traded over the counter OTC.

Binary options are an example of exotic options. They are characterised by only two possible outcomes which can be used to speculate on price movements.

Because the payoff is restricted in this scenario, traders often combine binary options with vanilla options. You can find the relevant calculators and pricing valuation formulas within the trading platform of your chosen broker. Vanilla options are a relatively low-risk financial instrument that can be executed using a variety of trading strategies. This article has covered definitions, explained the different types of vanilla options, plus their benefits and drawbacks.

Before deciding whether trading with vanilla options what is options trading example right for you, you may want to consider alternative options instruments. Vanilla options are a hedging strategy used by traders, where holders can buy or sell an underlying asset at a predetermined price in the future.

Vanilla options consist of call the right to buy and put the right to sell options. Binary options are a simple way to trade price fluctuations in a short period of time. Vanilla options, on the other hand, offer a longer period of time and greater flexibility to profit from market dynamics.

There are plenty of FX brokers who offer options trading, including IG, eToro, Avatrade and easyMarkets. You can trade a variety of assets with vanilla options, including foreign exchange, stocks, bonds, and commodities. Beginners should always ensure they fully understand the risks involved with leveraged trading. Brokers Reviews investing 12Trader 4xCube AAAFx AccentForex ActivTrades Admiral Markets AdroFX ADS Securities AETOS AGEA Ally Invest Alpari Alpho Alvexo Amana Capital AMarkets ArgusFX Arum Capital AskoBID ATC Brokers Atiora Avatrade Awesome Miner Axes Axi Axiory Ayondo BCS Forex BDSwiss Binance Binary.

com BinaryCent Binomo Bitfinex Bithoven Bitlocus BitMex BlackBull Markets Blackwell Global BMFN BP Prime Bulbrokers BUX X BUX Zero Bybit Capex Capital Index Capital. com Celsius CFD Global FX CGS-CIMB City Credit Capital CityIndex CIX Markets CMC Markets CMSTrader CMTrading Cobra Trading Coinbase CoinMama Colmex Pro CommSec Core Spreads Corsa Capital CPT Markets CrescoFX Crypto. com Daniels Trading Darwinex Degiro DeltaStock Deriv. com DIF Broker DirectFX DMM FX Dsdaq Dukascopy E-Trade EagleFX Easy Markets Eightcap Equiti ETFinance eToro ETX Capital EuropeFX EverFX eXcentral Exness Expert Option EZ Invest FBS FCMarket FIBO Group Fidelity Financial Spreads Financika Finexo Finotrade Finq.

com Finspreads Fondex Forex, what is options trading example. com Forex4you ForexMart ForexTB FortFS Fortrade FP Markets Freetrade FreshForex Fulcrum Fullerton Markets Fusion Markets Futu FXCC FXChoice FXCM FXDD FXFlat FXGiants FxGlory FXGM FxGrow FxNet FXOpen FXPIG FXPrimus FXPro FXTM FXTrading Gate, what is options trading example. com Mega Trader FX Mitto Markets Moneta Markets Moomoo MTrading MultiBank FX Nadex Naga NBH Markets NiceHash NicoFX NinjaTrader Noble Trading NordFX NPBFX NSFX Nuo Oanda OBR Invest OctaFX OKEx Olymp Trade Optimus Futures Orbex OspreyFX PaxForex Paxful Pepperstone Pionex Plus Price Markets PrimeXBT ProfitiX Q8 Trade Questrade Quotex Robinhood RoboForex RoboMarkets ROInvesting Sage FX Saxo Bank Sharekhan SimpleFX Skilling.

com Smart Prime FX SmartFX Spectre. ai SpeedTrader Spread Co Spreadex SquaredFinancial StormGain Stratton Markets StreamsFX Superforex What is options trading example SVK Markets Swissquote SynergyFX Tastyworks TD Ameritrade What is options trading example TeraFX ThinkMarkets Tickmill Tier1FX Tiger Brokers TIO What is options trading example TMS Brokers TP Global FX Trade Nation Trade Pro Futures Trade Republic Trade.

Reviews investing 12Trader 4xCube AAAFx AccentForex ActivTrades Admiral Markets AdroFX ADS Securities AETOS AGEA Ally Invest Alpari Alpho Alvexo Amana Capital AMarkets ArgusFX Arum Capital AskoBID ATC Brokers Atiora Avatrade Awesome Miner Axes Axi Axiory Ayondo BCS Forex BDSwiss Binance Binary.

com Trade12 Trade Trader's Way TradeStation TradeTime Tradeview Trading TrioMarkets TusarFX UFX Unidex Uptos Valutrades VantageFX Varianse Videforex Webull Weltrade WH SelfInvest Windsor Brokers XGlobal Markets XM XTB XTrade ZacksTrade Zenfinex Zero Markets ZuluTrade.

Forex Forex Trading Forex Brokers. CFD CFD Trading CFD Brokers. Stocks Stock Trading Stock Brokers. Crypto Cryptocurrency Bitcoin Ethereum Ripple Litecoin Dash EOS Monero QTUM Tron Tether. Guides Copy Trading Leverage Trading Strategies Technical Analysis Trading Patterns Risk Management Short Selling Scalping Trading Books Education Tips Trading For a Living Taxes Binary Options Digital Options Futures Trading Options Trading Markets Islamic Trading Weekend Trading Swing Trading Trading Rules Spread Betting Glossary Bonus Payment Methods Trading Secrets Passive Income Trading Regulation YouTube Channels Margin Trading.

Tools Demo Accounts Social Trading Charts Apps Auto Trading Software Trading Services Alerts Stock Screener Ideas. Home Options Trading. Contents What Are Vanilla Options? What are vanilla options? What is the difference: binary options vs. vanilla options? Where can I trade vanilla options? What assets can I trade with vanilla options? Are vanilla options good for beginners?

5 Options Trading Strategies for Beginners [Higher Return, Lower Risk]

, time: 53:43How to Make Money Trading Options, Option Examples

27/04/ · Options trading is the act of buying/selling a stock's option contracts in an attempt to profit from the stock's future price movements. Traders can use options to profit from stock price increases (bullish trades), decreases (bearish trades), or even when a stock's price remains in a specific range over time (neutral trades) 09/11/ · How does Call Option Trading work? Let’s understand it even better, consider a simple hypothetical. For Example: You expect the price of a share XYZ ltd. to go Rs at the end of the week, which is now trading at Rs only. But for whatever reason, which could be liquidity or just general doubt, you don’t buy the shares In very simple terms options trading involves buying and selling options contracts on the public exchanges and, broadly speaking, it's very similar to stock trading. Whereas stock traders aim to make profits through buying stocks and selling them at a higher price, options traders can make profits through buying options contracts and selling them at a higher price

No comments:

Post a Comment