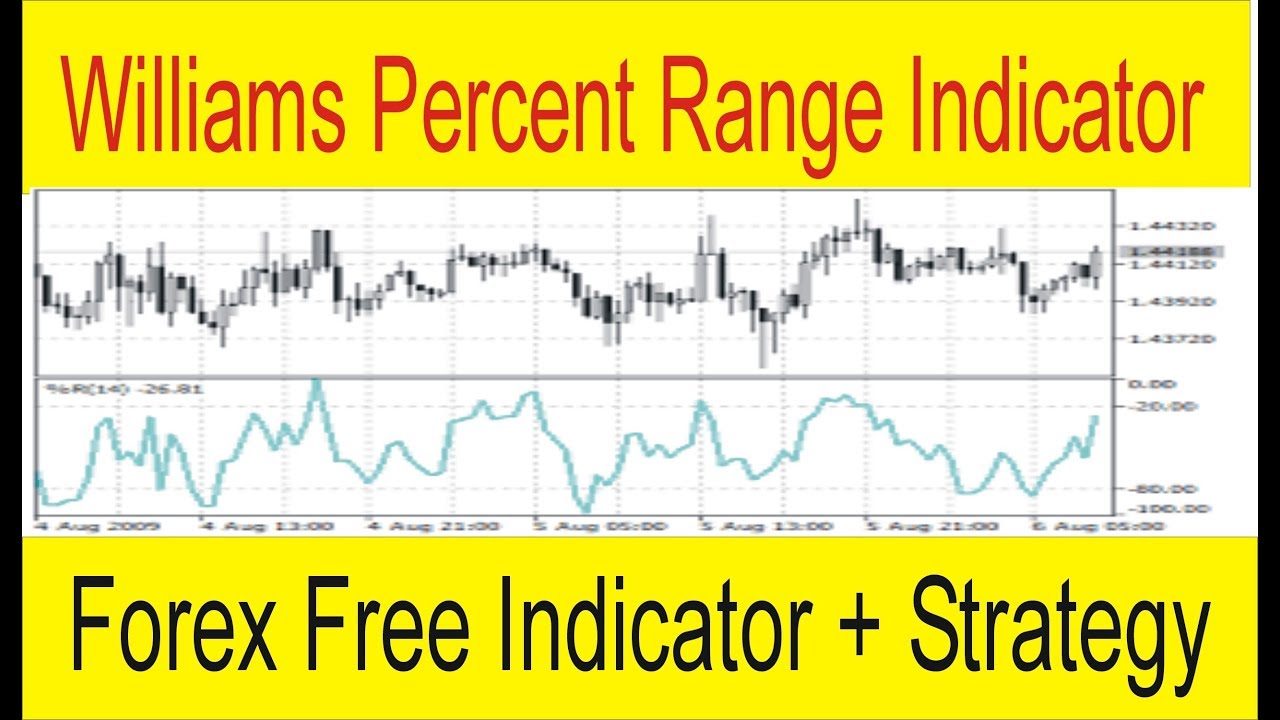

Williams` Percent Range - %R: description, adjustment and application. Technical Indicator Williams` Percent Range (%R) is a dynamic indicator, which determines overbought or oversold condition of the market. Williams` Percent Range is and Stochastic Oscillator are very similar 30/07/ · The Williams Percent Range is an indicator in Forex trading used to determine closing price levels in relation to the lowest and highest prices within a given period. Also known as Williams %R, this indicator helps traders to identify oversold and overbought conditions in the market. The Williams %R is much similar to Stochastic Indicator Williams' Percent Range MetaTrader 4 Forex Indicator is a dynamic pointer, which decides if the market is overbought/blogger.comtor is almost the same as the Stochastic Oscillator. The main distinction is that Williams Percent Range has a upside down scale and the Stochastic Oscillator has inward smoothing

Williams Percent Range Forex Indicator

It is best applied to trending markets. It is exactly the opposite of the Fast Stochastic Oscillator in that it compares the level of the close to the highest high during the lookback period, williams percent range forex indicator, while the fast stochastic oscillator reflects the level of the close relative to the lowest low. Thus, the two oscillators readings are an exact match when used with the same trackback span of course but their scaling is different, williams percent range forex indicator.

The areas between and 0, and and are considered as overbought and oversold, respectively. In case the close touches the highest high, the indicator will hit 0. Williams percent range forex indicator, if it drops williams percent range forex indicator the lowest low of the tracked range, it will decline to As you can see, they are an exact match.

As we said, the range between 0 and is considered as overbought, while values between and are deemed oversold. Of course, these levels can be adjusted to match current market conditions — if volatility is continuously being low, the thresholds can be loosened for example to and Generally, overbought and oversold conditions indicate an upcoming reversal or at least a retracement, but this is not always the case.

Thus, successful frequent overbought and oversold reversals are most typical for ranging markets and weaker trends. Generally speaking, a buy signal is generated when the oscillators value falls into oversold territory, reverses and enters back the normal range. For example, if a currency had successfully risen above for two-three consecutive times but it failed at the fourth attempt, it suggests that the weakening buying pressure exerted by bulls is preceding a price decline.

Skip to content Ultimate Oscillator. Williams Percent Range This lesson will cover the ading the indicfollowing Definition Calculation Interpretation. Ultimate Oscillator.

How To Use The Williams %R Indicator (Trading Strategy)

, time: 9:59Williams Percent Range (WPR) Forex Indicator Explained

Williams' Percent Range MetaTrader 4 Forex Indicator is a dynamic pointer, which decides if the market is overbought/blogger.comtor is almost the same as the Stochastic Oscillator. The main distinction is that Williams Percent Range has a upside down scale and the Stochastic Oscillator has inward smoothing Trading the indicator. Just like any other bound oscillator, the Williams %R is designed to identify overbought and oversold conditions, which in terms signal possible price reversal or at least retracement levels. As we said, the range between 0 and is considered as overbought, while values between and are deemed oversold 16/01/ · January 16, by proforexsignals. Our custom developed Forex Williams Percent Range Histogram Indicator. Williams %R, also known as the Williams Percent Range, is a type of momentum indicator that moves between 0 and and measures overbought and oversold levels. The Williams %R may be used to find entry and exit points in the market

No comments:

Post a Comment