09/05/ · Bollinger bands on RSI means we are going to plot Bollinger bands on RSI indicator. As we know, Bollinger bands are calculated and plotted on prices, instead of prices we are going to plot it on Relative strength index (RSI). So, basically it is an indicator on indicator. When we plot indicator on indicator we get a whole new view to analyze asset prices 03/07/ · Bollinger bands and RSI strategy with freqtrade. by CryptoCue. July 3, There are multiple ideas that you can use to trade with Bollinger bands. First, we need to know if we’re going to use Talib Bollinger bands or qtpylib. For this example, I’ll choose qtpylib Bollinger bands and the RSI provided by Talib blogger.comted Reading Time: 2 mins 25/10/ · Bollinger Bands + RSI Trading Strategy tested TIMES - Will this make PROFIT for you? If playback doesn't begin shortly, try restarting your device. Videos you Author: TRADING RUSH

The Bollinger Bands and Relative Strength Index (RSI) Strategy - The Babylonians

The strategy of using the Bollinger Bands and RSI is extremely powerful. This is a fresh new series of technical analysis that I have not covered before. For many of the readers who have been following my blog for quite some time, you would have realised that all my posts under the technical analysis section are Ichimoku Cloud charts. While Ichimoku Cloud has its own strength and merits, they usually work best for trending markets or swing trading.

The reason why I decided to do a post on the strategy of Bollinger Bands and RSI is that it allows us to know whether prices are high and overbought or bollinger bands rsi strategy and oversold. It is as simple as that, but obviously not as easy as the way I have said it. Before you make a buy or sell decision, you can plot on these 2 indicators to provide additional confirmation or disconfirmation. All it takes is 1 minute and you would have generated extra insights by using this strategy.

But I do believe that one should be adaptable and versatile to the different tools, indicators and thinking in technical analysis, bollinger bands rsi strategy. There is no fixed system or fixed way of looking at charts. Things change and market changes. Sometimes you use this and other times you use that. This can help better time your entry or exit points. Leading indicator means it is designed to precede future price movements. It gives a signal before something happens.

I found a good diagram from Babypips that pretty sums up everything about the leading indicator. You can see that the leading indicator sort of gives an early warning signal before a trend reversal occurs. The downside of leading indicators is that they are less reliable and can sometimes lead to false signals.

Bollinger bands rsi strategy that nothing is an absolute certainty in technical analysis. On the other hand, the lagging indicator provides a signal only AFTER something has happened.

While the lagging indicator is more accurate, the bad news is you are probably late at the party when a lagging indicator shows up. Bollinger Bands is developed by John Bollinger in the s and it is commonly used to measure the volatility of an asset, bollinger bands rsi strategy. Here is how Bollinger Bands looks like on bitcoin. There are 3 components to Bollinger. The first one is just a simple day moving average which is represented by the middle band, bollinger bands rsi strategy.

The second and third is the upper and lower bands that are two standard deviations away from the day SMA. It has much lesser components in comparison to Ichimoku. A 20 SMA red middle line is just the AVERAGE closing price of the past 20 days. It is really all there is to it.

You can check out on Investopedia on how moving averages are calculated. The upper and lower bands are slightly more complicated since it deals with the study of statistics. Standard deviation measures how far or near the data points are in comparison to the mean. If the standard deviation is low, it means the prices are very close to the mean.

If the standard deviation is high, it means prices are spread out far away from the mean. So what dos the upper and lower band signify? What does it mean to say that the upper and lower bands are 2 standard deviations above or below the mean?

To put this into context, the mean we are talking about in Bollinger Bands is the day simple moving average, bollinger bands rsi strategy. The standard deviation is the past 20 data points, bollinger bands rsi strategy. Imagine a data set of 20 prices, calculate the mean, calculate the difference between each price data with the mean, square it, sum it up and square root it. That will give the standard deviation figure over the past 20 days.

The chances that the price would touch either the upper band or lower band is This can be seen from the above diagram. The chances that price would exceed the upper band or lower band is approximately 2. Usually, in such cases, the price would rebound bollinger bands rsi strategy retrace back sharply back within the upper and lower bands.

That is the reason why you see the candlesticks are pretty much contained within the Bollinger Bands. When the price moved BEYOND 2 standard deviations from the mean, it is usually an extreme overbought or oversold position. Relative Strength Index or RSI is a momentum oscillator that measures the speed and change of price movement. The RSI oscillates between 0 towhere anything above 70 traditionally represents overbought and anything below 30 represents oversold.

The formula for computing RSI is as follows. RS stands for Relative Strength. The formula of RS is slightly more tricky, bollinger bands rsi strategy. The traditional setting for RSI is to use a day period. That is for the first 14 data points. Any price that comes after bollinger bands rsi strategy 14th data point would have a slightly different calculation.

In computing a simple moving average, the average price would continuously be the average of the past 14 days. The different aspect of RSI is that it takes a smoothed average that puts heavier weighting on the bollinger bands rsi strategy data.

This is the precise reason why RSI is a leading indicator. It is because the latest price has a significant influence on the value of RSI. To illustrate, the day simple moving average on day 15 would be the average of prices from day 2 to day the day simple moving average on day 16 would be the average of prices from day 3 to day In computing the smoothed average on day 15, it would be 13 MULTIPLY by the average price from day 1 to day 14 Bollinger bands rsi strategy the current price on day 15, DIVIDED by In computing the smoothed average on day 16, it would be 13 MULTIPLY by the average price from day 2 to day 15 PLUS the current price on day 16, DIVIDED by After computing the value of RS, simply sub it into the formula and you would get an RSI value of anything between 0 to The lower the value of RS, the closer RSI approaches towards ZERO.

The higher the value of RS, the closer the RSI approaches towards Based on the formula above, bollinger bands rsi strategy, it would only oscillate between 0 and If RS is higher, it means the smoothed average gain is higher than the average loss.

If RS is lower, it means the average loss is higher than the average gain. So if you see RSI creeping up higher and higher, that means the average gains to losses are getting higher and higher. Vice versa if RSI is sloping downhill, it simply means the average losses are getting higher and higher every day, bollinger bands rsi strategy. In Bollinger Bands, we mentioned that prices would always be contained within the upper and lower bands.

In the case of Bollinger Bands, we are using the period moving average and period standard deviation. The traditional way of using Bollinger is to trade for reversals. If a price hits the upper or lower band, it is likely to reverse as prices have already reached the extreme end.

You can see from the below diagram that the price of gold sort of bounces between the upper and lower band. Of course, things are not so simple in real life if not everyone else would be making money. In RSI, we mentioned that it is an oscillator that oscillates between 0 to Anything above 70 is considered overbought and anything below 30 is considered oversold, bollinger bands rsi strategy.

Similarly, RSI can be used as an indicator to give an early signal of a reversal. To illustrate, here is how it works. Remember that leading indicator provides an early warning signal before a trend reverses. You can see that when RSI hits the overbought region, after a couple of days the trend begin to reverse and slope downwards.

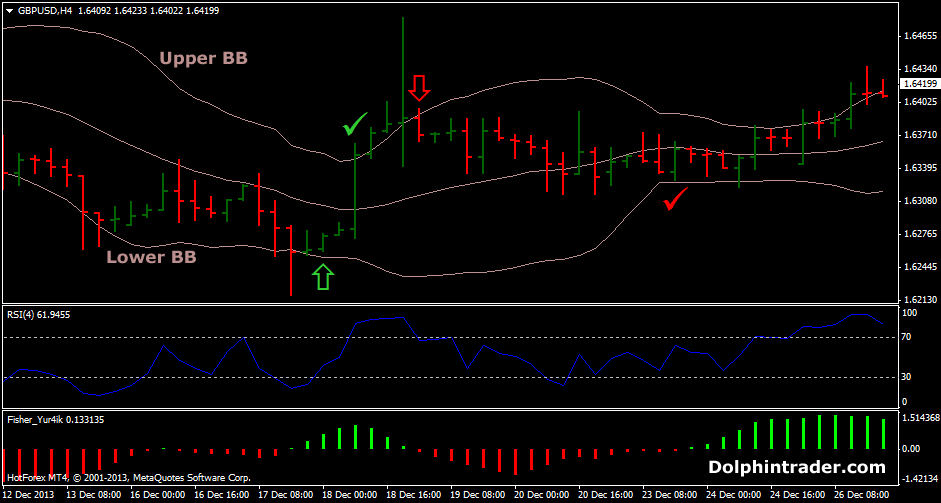

Conversely, when RSI hits the oversold region, after a few days the trend begins to reverse and slope upwards. Again, things are not as simple in real life else everyone would be rich. The strategy of using Bollinger Bands and RSI is to watch for moments when prices hit the lower band and RSI hits the oversold region Below This would be a good entry price to buy. If you are looking to sell, you can wait for prices to hit the upper band and RSI hits the overbought region above The tricky part about this strategy is that prices can remain overbought or oversold for a long period of time, bollinger bands rsi strategy.

From weeks to months. Similarly, prices can hover around the upper band or lower band for a long period of time. The price continues to increase along with the upper band and RSI continues to hover above There are times when prices continue to fall and stick along the lower band and RSI continues to stay below BUT, it does give you a good sense of where prices are at the moment.

To further enhance our strategy, we have to add in more confirmations. The first confirmation is known as the RSI divergence. This is when prices are making higher highs BUT RSI is NOT making higher highs. OR when prices bollinger bands rsi strategy making lower lows but RSI is NOT making lower lows.

You can see that before the first big crash came, prices are making higher highs. BUT, the RSI is showing a divergence.

KILLER Strategy Bollinger Bands + RSI - RESULTS EXPOSED

, time: 18:404 Hour RSI Bollinger Bands Forex Trading Strategy

03/07/ · Bollinger bands and RSI strategy with freqtrade. by CryptoCue. July 3, There are multiple ideas that you can use to trade with Bollinger bands. First, we need to know if we’re going to use Talib Bollinger bands or qtpylib. For this example, I’ll choose qtpylib Bollinger bands and the RSI provided by Talib blogger.comted Reading Time: 2 mins 09/05/ · Bollinger bands on RSI means we are going to plot Bollinger bands on RSI indicator. As we know, Bollinger bands are calculated and plotted on prices, instead of prices we are going to plot it on Relative strength index (RSI). So, basically it is an indicator on indicator. When we plot indicator on indicator we get a whole new view to analyze asset prices 25/10/ · Bollinger Bands + RSI Trading Strategy tested TIMES - Will this make PROFIT for you? If playback doesn't begin shortly, try restarting your device. Videos you Author: TRADING RUSH

No comments:

Post a Comment