02/12/ · You Can’t Afford To. You generally have 90 days once you leave the company to buy your options. If the choice is between buying an option lottery ticket or paying your rent or your student debt, then you probably will have to pass on buying your options unless you can get a nice loan from your parents. The Company Is blogger.comted Reading Time: 8 mins 21/07/ · On the other end, if a stock loses value below the strike price of the call option, it is considered out of the money. When trading put options, they are considered out of the money if the stock rises above the strike price of the options. Because stock options that are out of the money have no profit, their intrinsic value is blogger.comted Reading Time: 10 mins In summary, if you are leaving your employer and have unexercised stock options, please take the following steps, as a starting point: Exercise all options before expiration, in most circumstances. It rarely makes sense to walk away if they have any current value at all

What Happens to Stock Options if I Leave the Company?

by Landon Loveall Jul 25, Employee Stock OptionsStock Options. Career development is a noble quest, but a lot of tech and startup employees can feel stuck in their current companies. The standard is 90 days, but making assumptions with a big financial move like this is never a good idea, so check those documents to know your timeframe. And here, there are two costs you need to plan for: the cost of the do you lose stock options when you quit itself, and the cost of taxes triggered by the options you exercise.

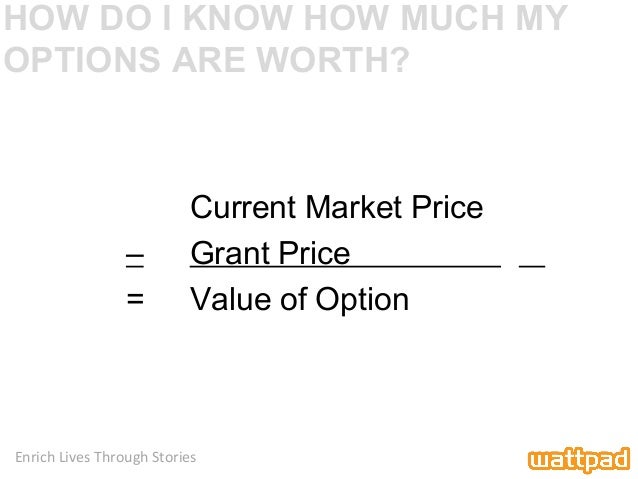

The cost of the exercise is pretty simple to calculate: How much will it cost to buy the number of shares you want to buy? This is not easy to calculate, especially in a year when you may or may not be cashing out other supplemental wages, are changing jobs, and are likely seeing a salary increase from one job to another.

That, and if you have incentive stock options, you could be faced with also having to pay the Alternative Minimum Tax, do you lose stock options when you quit. Figure Out Exercise Cost. And I get the excitement, but financially speaking, do you lose stock options when you quit, it can be a lot better to hold your horses for a little while. In my opinion, paying for the exercise yourself is the best way to go about it.

These are contract negotiations with your new employer. I know, I know. But if you do decide to go this route, talk about the terms in advance, and put it in writing. And keep it simple, like a simple percentage split at the time of IPO or acquisition. For example, one person could give you a certain money amount to exercise your options and pay taxes on them, and then after the IPO, you give them a set percentage of your shares. Believe it or not, there are lenders out there who specialize in lending money to people who want to exercise stock options, do you lose stock options when you quit.

You can take out a loan from them or borrow money against your house in a HELOC home equity line of credit. Prepare your notice to give to your current employer, make negotiations with your new employer, budget your cash or secure your funding for the exercise, and move on to your new job! Cost basis is crucial when calculating taxesand will save you some massive headaches.

However, most companies make exercising your stock options in the time frame of you quitting your job fairly easy and straightforward. Just make sure you check your grant documents for the exercise time frame, and calculate your current and future costs before you make any moves. And, if you want help with the calculations and advice on how much to exercise to make the most of your stock options before you switch jobs, talk to one of our advisors. Make a Plan for Quitting. Stock Options When You Quit: What Do You Do?

How Do You Cash In? Search for:. Money Blog Categories Building Wealth 39 Buying A House 7 Employee Stock Options 29 Financial Planning 73 IPO 23 IRS 2 Paying for College 1 San Francisco 20 Stock Options 50 Tax Planning 35 Tech Companies 7 Tech Industry 29 Tender Offers 7 Uncategorized 3. Receive latest posts in your inbox! Recent Posts How to Start Investing: 6 Keys to Smart Investments Are You Behind On Long-Term Financial Goals?

Tags buying a house expiring lockup IPO Articles IRS nonqualified options stock options tax reform tech employees tech IPOs tender offers uber softbank do you lose stock options when you quit.

What Happens to Options at Expiration? - Comment Below

, time: 7:16What Happens to Your Stock Options When You Leave a Startup? - EquityBee Blog

21/07/ · On the other end, if a stock loses value below the strike price of the call option, it is considered out of the money. When trading put options, they are considered out of the money if the stock rises above the strike price of the options. Because stock options that are out of the money have no profit, their intrinsic value is blogger.comted Reading Time: 10 mins The stock options that have vested are yours to keep when you separate from a company, whether voluntarily or otherwise. Most companies issue stock options as part of their employee compensation packages that specify a specific number of options a 25/07/ · If you’ve got the standard day expiration period and you leave your job in September, it means you’ll have to exercise your stock options in December to get them in before the 90 days are up. When this happens, the exercise falls within the current calendar year, and you’ll have to pay taxes on this financial move in blogger.comted Reading Time: 6 mins

No comments:

Post a Comment